Loading

Get Ira Account Statement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ira Account Statement online

This guide provides clear, step-by-step instructions for completing the Ira Account Statement online. By following these detailed directions, users can ensure the accuracy and efficiency of their submissions.

Follow the steps to complete your Ira Account Statement online.

- Click ‘Get Form’ button to obtain the form and access it in the designated online editor.

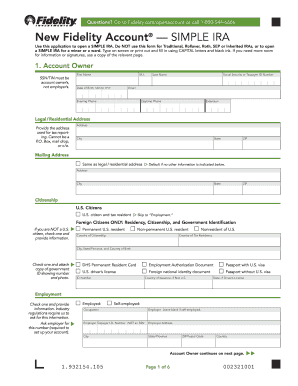

- In the 'Account Owner' section, enter the first name, middle initial, and last name of the account owner. Ensure to provide the Social Security or Taxpayer ID Number belonging to the account owner specifically.

- Fill in the account owner's date of birth in the specified format (MM DD YYYY) and provide a valid email address along with evening and daytime phone numbers.

- Complete the legal or residential address section. This should be the address used for tax reporting and cannot be a P.O. Box. Include city, state, and ZIP code.

- If the mailing address differs from the legal/residential address, check the appropriate box and provide the necessary information.

- Indicate citizenship status. For foreign citizens, provide details about residency, government identification, and fill in the corresponding sections as instructed.

- In the employment section, indicate your employment status by checking the appropriate box and providing the necessary details including occupation and employer's information.

- Continue on the next page to complete the financial profile section, detailing your investment objectives and financial situation. This information is required for compliance and to better understand your investment needs.

- Designate beneficiaries if desired. This step is optional, but leaving it blank indicates no chosen beneficiaries.

- Review the completed form for accuracy. Ensure all required fields are filled out and correct any information as necessary before submitting.

- After verifying, you can save the changes, download, print, or share the completed form according to your needs.

Complete your documents online today to ensure a smooth process!

You receive a 1099 form for a traditional IRA if you take any distributions. This form is essential for tax reporting, as it details the amount you withdrew. Regularly reviewing your IRA account statement will help you keep track of your withdrawals and contributions. If you did not withdraw funds, you will not receive a 1099.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.