Get Insurance Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Insurance Form online

Filling out an insurance form online can seem daunting, but with careful attention to detail and a clear understanding of each section, the process can be straightforward. This guide will walk you through the steps to successfully complete the Insurance Form.

Follow the steps to fill out the Insurance Form with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

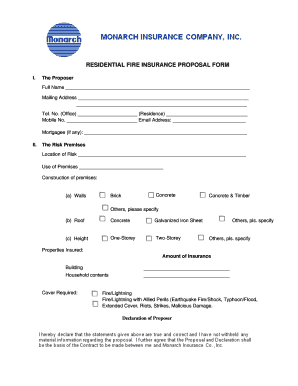

- In the 'The Proposer' section, provide your full name, mailing address, and contact information, including office and residence telephone numbers, mobile number, and email address. If applicable, include the name of your mortgagee.

- Move to 'The Risk Premises' section. Here, you need to write the location of the premises, describe its usage, and specify the construction materials.

- For the construction of the premises, detail the materials used for the walls by selecting from concrete, brick, concrete & timber, or others, while providing specifics if needed. Do the same for the roof, indicating if it is made of concrete or galvanized iron sheet.

- Indicate the height of the premises by selecting one-storey, two-storey, or others, specifying details as necessary.

- Next, list the properties that you wish to insure by selecting 'Amount of Insurance' for both buildings and household contents.

- Select the cover required by checking the appropriate options: Fire/Lightning or Fire/Lightning with Allied Perils, including specific events such as earthquake/fire/shock, typhoon/flood, extended cover, riots, strikes, or malicious damage.

- Finally, read the declaration and sign and date the form to confirm the information provided is accurate.

- Once completed, make sure to save your changes, and you will have the option to download, print, or share the form as needed.

Complete your documents online with confidence!

The short form of insurance typically refers to simplified or abbreviated insurance policies that cover essential needs without excessive details. These policies allow individuals to obtain necessary coverage quickly and efficiently. However, it is important to ensure that the short form adequately covers your requirements. Utilizing an insurance form can help you quickly identify your coverage goals and select the right policy that suits your needs.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.