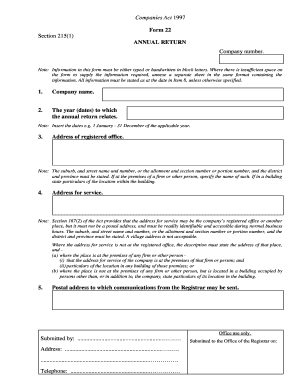

Get Companies Act 1997 Form 22 Section 215(1) Annual Return Company Number - Ipa Gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Companies Act 1997 Form 22 Section 215(1) ANNUAL RETURN Company Number - Ipa Gov online

This guide provides a clear and supportive framework for filling out the Companies Act 1997 Form 22 Section 215(1) Annual Return. By following the steps outlined, users with various levels of experience can successfully complete and submit this important form.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the company name at the designated field. Ensure that you provide the full legal name as registered.

- Provide the year or specific dates to which the annual return relates. For example, insert '1 January - 31 December' of the applicable year.

- Fill in the address of the registered office. This should include the suburb, street name and number, and any relevant specifics (e.g., allotment number).

- Specify the address for service. This can be the registered office or another identifiable location that is accessible during business hours, and must not be a postal address.

- Provide a postal address for communications from the Registrar.

- Insert the date of the annual meeting held or deemed to be held for the year. If there was a resolution instead, note 'Section 103 resolution' and the date.

- State the date of the last annual meeting held or deemed to be held.

- Enter the date to which this annual return is made up to or not later than 14 days after the annual meeting.

- Complete the section on details of registered charges, entering the registration number, date, name of chargeholder, and amount outstanding.

- If applicable, provide information about records not kept at the registered office.

- Indicate the number of full-time and part-time employees, inserting 'Nil' if there are none.

- Answer whether the company has traded since the previous annual return. State principal activities and commencement dates if applicable.

- Fill in information regarding shares in the company, detailing the class, number of shares, and prices.

- Provide the total number of shares of the company on issue and insert relevant amounts for calls received and unpaid.

- Enter the total number of shares forfeited and provide any details of shares purchased or redeemed.

- Summarize share transfers since the last annual return; insert 'Nil' if none occurred.

- If applicable, include particulars of the ultimate holding company.

- For companies with fewer than 100 shareholders, provide shareholder information, ensuring all required details are captured.

- Include details of directors and, if applicable, secretaries, ensuring all relevant personal information is accurately captured.

- Indicate whether the company is exempt from appointing an auditor and provide auditor details if relevant.

- State the total value of the company’s assets and liabilities as at the last balance date.

- Complete the declaration and provide the signature and name of the director or secretary, along with their role and date.

- Finally, save changes to the form, and proceed to download, print, or share it as needed.

Complete your Companies Act 1997 Form 22 Section 215(1) online efficiently!

The annual return of the Companies Act represents a statutory obligation for companies to report key information about their operations annually. According to the Companies Act 1997 Form 22 Section 215(1) ANNUAL RETURN Company Number - Ipa Gov, it provides a snapshot of the company’s financial and structural status. Filing this return helps maintain transparency and facilitates checks by regulatory bodies. By staying compliant, companies can avoid penalties and demonstrate their commitment to good governance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.