Loading

Get Gnma Form 11710e 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Gnma Form 11710e online

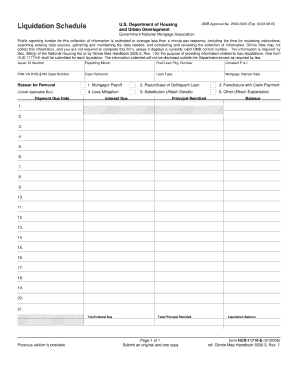

Filling out the Gnma Form 11710e online can be a streamlined process if you understand each section clearly. This guide provides detailed and supportive instructions to help you navigate the form efficiently.

Follow the steps to fill out the form accurately online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin by reviewing the header of the form. This section typically contains important instructions and identifies the form as the Gnma Form 11710e, ensuring you are working on the correct document.

- Proceed to the personal information section. Here, you will need to enter relevant details such as your name, address, and contact information. Make sure that all entries are accurate and up-to-date.

- Next, navigate to the financial information section. This part usually requires you to provide your income details and any pertinent financial data. Take your time to ensure all figures are correctly entered.

- Then, review the eligibility criteria section. Answer any questions as required, ensuring that you meet the qualifications set forth in this part of the form. It’s essential for your application to be valid.

- Finally, after completing all sections, review the entire form to check for any errors or omissions. Once satisfied, you can save your changes, download, print, or share the form as needed.

Start completing the Gnma Form 11710e online today and ensure all your details are accurately recorded.

The primary purpose of GNMA is to promote stability and affordability in the housing finance system. It achieves this by guaranteeing government-issued mortgage-backed securities, which encourages lenders to extend mortgage loans to a broader audience. This support ultimately aims to enhance home ownership across the United States. Utilizing resources like the Gnma Form 11710e can facilitate your participation in this vital sector.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.