Loading

Get Ia Form 843 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IA Form 843 online

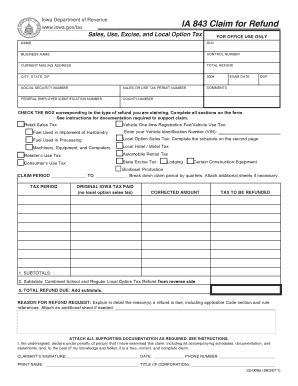

The IA Form 843 is a crucial document for individuals and businesses seeking a refund for overpayments related to sales, use, excise, and local option taxes in Iowa. This guide will provide a clear and comprehensive overview of how to correctly fill out this form online, ensuring that your refund request is complete and accurate.

Follow the steps to fill out the IA Form 843 effectively.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name and the business name (if applicable) in the designated fields. Make sure the information is accurate to avoid any processing delays.

- Fill in your current mailing address, including the city, state, and ZIP code. This information is essential for receiving communication regarding your claim.

- Indicate your total refund amount clearly. In case you are filing for a specific type of tax refund, check the appropriate box that corresponds to your refund type.

- Provide your Social Security Number or Federal Employer Identification Number, as required. Ensure that this information is correctly entered to prevent any issues with your claim.

- In the reason for refund request section, give a detailed explanation as to why you believe a refund is due, including references to any applicable code sections or rules.

- If necessary, include any additional documentation that supports your claim. This may include invoices, exemption certificates, or detailed descriptions required for specific refund types.

- Review all sections of the form for completeness and accuracy. Ensure you have signed and dated the claim before submitting.

- Finally, save your changes, and if needed, download, print, or share the form as per your requirements.

Ensure your refund documents are completed accurately online to facilitate a smooth refund process.

At this time, you cannot file IA Form 843 electronically with the IRS. You need to fill out the form on paper and send it via postal mail. If you’re looking for assistance in managing this process, uslegalforms can simplify filling out and filing your form correctly, ensuring you don’t miss any crucial steps.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.