Get Charity Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Charity Form online

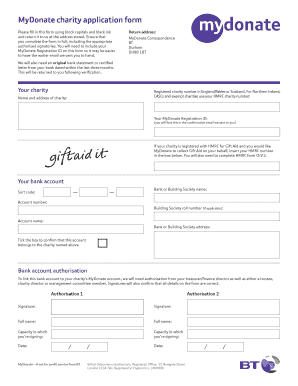

Filling out the Charity Form online is a straightforward process that enables charities to submit their application efficiently. This guide provides step-by-step instructions to help users complete the form accurately, ensuring all necessary information is included.

Follow the steps to complete your Charity Form online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the name and address of your charity in the designated fields. Ensure that the information is accurate and up-to-date.

- Input your registered charity number, which could be from England, Wales, Scotland, or your HMRC charity number if you are registered in Northern Ireland.

- Locate and enter your MyDonate Registration ID, which you can find in the confirmation email sent to you.

- If your charity is registered with HMRC for Gift Aid, provide your HMRC number in the appropriate field. Remember, you will also have to complete the HMRC form ChV1.

- Fill in the bank account information. Include the name of your bank or building society, sort code, account number, and account name.

- If applicable, add the building society roll number and the address of your bank or building society.

- Tick the box confirming that the bank account belongs to the charity named above.

- For bank account authorization, provide signatures and details for the treasurer or finance director, as well as a trustee, charity director, or management committee member. Ensure that the capacity in which each person is signing is noted.

- After completing the form, review all entered information for accuracy. Once everything is correct, save your changes, and you may download, print, or share the form for submission.

Complete your Charity Form online today to facilitate your charity application process.

To qualify as a charity, your organization must operate for charitable purposes, such as alleviating poverty, advancing education, or promoting health. It is essential to fill out the charity form correctly and apply for tax-exempt status. This status not only legitimizes your charity but also encourages donations by providing tax benefits to donors. Be sure to consult resources like US Legal Forms to assist you with your application and improve compliance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.