Loading

Get Proposition 60 & 90 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Proposition 60 & 90 Form online

Filling out the Proposition 60 & 90 Form is an essential step for individuals aged 55 and older looking to transfer their base year value to a replacement dwelling. This guide provides clear and supportive instructions to help you complete the form online with ease.

Follow the steps to complete your Proposition 60 & 90 Form online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

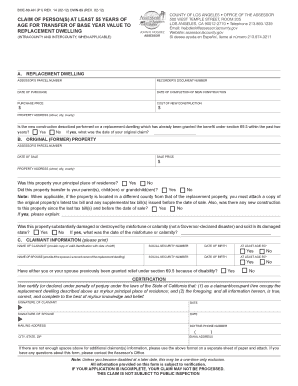

- Begin by filling out the Replacement Dwelling section. Provide the assessor’s parcel number, recorder’s document number, date of purchase, date of completion of new construction, purchase price, and cost of new construction. Ensure the property address is filled out accurately.

- Indicate whether the new construction has previously been granted the benefit under section 69.5 within the past two years. If yes, include the date of your original claim.

- Proceed to the Original (Former) Property section. Enter the assessor’s parcel number, date of sale, and sale price for the original property. Confirm if the property was your principal place of residence.

- Answer whether the property transferred to your parent, child, or grandchild, and respond to inquiries about any new construction or if the property was damaged or destroyed by misfortune or calamity.

- Complete the Claimant Information section. Provide your name, social security number, date of birth, and confirm you are at least age 55. If applicable, also include your spouse's details.

- Review the Certification section. This declaration asserts that the information you provided is accurate and true to the best of your knowledge.

- Sign and date the form. If you have a spouse, their signature is also required.

- Provide your mailing address, daytime phone number, city, state, zip, and email address.

- If necessary, attach additional claimant information on a separate sheet of paper, following the provided format.

- After filling out the form, you may save your changes, download a copy, print, or share the form as needed.

Start your online application for the Proposition 60 & 90 Form today.

Proposition 60 and 90 in California refer to laws designed to assist seniors and disabled individuals in transferring their property tax base to a new home. Utilizing the Proposition 60 & 90 Form, eligible homeowners can move without incurring significant tax increases. Understanding these provisions can provide considerable financial relief when relocating within California.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.