Get Employee Representation Regarding Use Of Company Vehicle

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Employee Representation Regarding Use Of Company Vehicle online

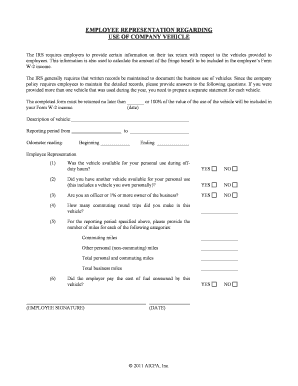

Filling out the Employee Representation Regarding Use Of Company Vehicle form is essential for employees who utilize company vehicles. This guide provides a clear and supportive approach to completing the form accurately online, ensuring compliance with IRS requirements.

Follow the steps to complete the form successfully.

- Press the ‘Get Form’ button to access the document and open it in the editor.

- Begin by entering the description of the vehicle you are reporting on. Ensure you provide accurate details, as this information is crucial for tax purposes.

- Fill in the reporting period by indicating the start and end dates. Ensure that the dates correspond to the time frame you are documenting.

- Record the odometer readings at the beginning and end of the reporting period. This will help provide a clear picture of the vehicle’s usage.

- Answer question (1) regarding the availability of the vehicle for personal use during off-duty hours with 'Yes' or 'No'.

- Respond to question (2), indicating whether you had another vehicle available for personal use.

- For question (3), clarify if you are an officer or own 1% or more of the business by selecting 'Yes' or 'No'.

- Complete question (4) by disclosing the total number of commuting round trips made in the vehicle during the reporting period.

- For question (5), provide the number of commuting miles driven, ensuring that you differentiate between personal and business miles.

- In question (6), document the total personal (non-commuting) miles and total business miles separately.

- Indicate whether the employer paid for the fuel consumed by the vehicle by choosing 'Yes' or 'No'.

- Sign the form in the designated area and date it before submission. Ensure the form is complete, as incomplete submissions may not be accepted.

- Once all fields are completed, you can save your changes, download a copy for your records, print out the document, or share it as required.

Complete your Employee Representation Regarding Use Of Company Vehicle form online today to ensure compliance and proper reporting.

In Australia, an employee use of company vehicle agreement outlines the terms under which an employee can use a company vehicle. This agreement typically specifies allowed uses, maintenance responsibilities, and insurance claims. Having a clear agreement protects both the employer and employee, ensuring mutual understanding. Consultation regarding employee representation regarding use of company vehicle can offer valuable insights for creating such agreements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.