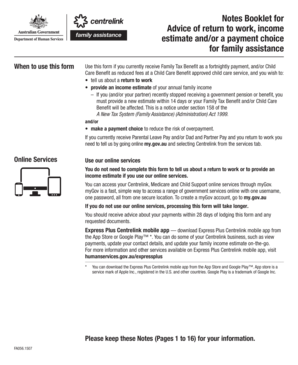

Get Advice Of Return To Work Income Estimate Andor A Payment Choice For Family Assistance

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Advice Of Return To Work Income Estimate Andor A Payment Choice For Family Assistance online

This guide provides detailed instructions on how to fill out the Advice Of Return To Work Income Estimate Andor A Payment Choice For Family Assistance form online. The systematic approach ensures that users can complete the form accurately and efficiently.

Follow the steps to successfully complete your form online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by entering your personal details including your full name, date of birth, and Centrelink reference number if known. Ensure that all fields are filled out accurately.

- Provide your contact information including a phone number and email address to enable communication. If you have a partner, ensure their details are also included.

- Indicate your current relationship status by selecting from the options provided, such as married, partnered, separated, etc.

- Answer the questions regarding your return to work status. Specify if you have returned to work for the first time after caring for a child.

- Report any periods of employment, self-employment, or leave you have had since returning to work. Provide details about your employer or self-employment, including names and contact information.

- Estimate your family's annual income by filling out the relevant sections for expected income from various sources such as employment, government benefits, and investments.

- If applicable, provide details regarding Child Care Benefit hours and any other related benefits to ensure you meet eligibility requirements.

- Review all your entries for accuracy and completeness. Ensure you have signed and dated the form where required.

- Once satisfied with your form, save your changes, download, print, or share the completed document as needed.

Complete your Advice Of Return To Work Income Estimate Andor A Payment Choice For Family Assistance online today.

The maximum Centrelink payment can vary based on the type of payment and the circumstances of your family unit. Payments such as family tax benefits are designed to assist families in varying financial situations. Your specific eligibility will depend on your income, family size, and other factors. For a detailed estimate and support in navigating the payment options available to you, refer to the Advice Of Return To Work Income Estimate Andor A Payment Choice For Family Assistance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.