Get Financial Planning Worksheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Financial Planning Worksheet online

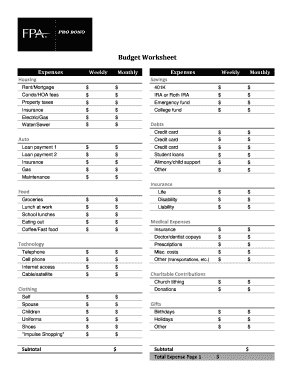

The Financial Planning Worksheet is a vital tool for managing your finances effectively. By filling out this worksheet, you can gain insights into your spending habits, savings goals, and overall financial health.

Follow the steps to fill out your Financial Planning Worksheet easily

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with the 'Housing' section. Enter your weekly and monthly expenses related to rent or mortgage in the designated fields. Include additional costs such as condo or HOA fees and property taxes.

- Proceed to the 'Savings' section. Input your contributions towards 401K, IRA or Roth IRA, and any emergency or college funds you have.

- Fill out the 'Debts' section. Record your credit card payments, auto loan payments, and any student loans. Include any alimony or child support payments as well.

- Next, move to the 'Food' section. List your weekly and monthly grocery expenses, along with costs for lunches at work, eating out, and coffee or fast food.

- In the 'Medical Expenses' section, document your medical costs, including copays and prescriptions.

- Complete the 'Entertainment' section by listing your spending on movies, concerts, books, and other leisure activities.

- In the 'Transportation' category, account for your transportation costs like gas, tolls, and any associated expenses.

- Conclude by reviewing your entries. Ensure all fields are accurately filled before saving your changes. You can then download, print, or share the completed form.

Start managing your finances today by completing your Financial Planning Worksheet online.

The seven steps of financial planning provide a structured approach to achieving financial stability. These steps include assessing your current financial situation, defining your financial goals, creating a financial plan, implementing the plan, monitoring your progress, adjusting as needed, and reviewing your plan regularly. A useful financial planning worksheet can guide you through each step effectively. By following these steps, you can ensure that you are on track to meet your financial objectives.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.