Loading

Get 2356

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2356 online

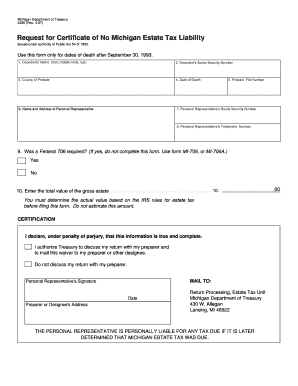

The form 2356 is a request for a certificate of no Michigan estate tax liability. This guide provides step-by-step instructions to assist users in accurately completing the form online.

Follow the steps to complete the 2356 form accurately.

- Click the ‘Get Form’ button to access the document and open it in your preferred editor.

- Begin by entering the decedent's name in the first field, including their first name, middle initial, and last name.

- In the next field, input the decedent's Social Security number accurately.

- Specify the county where the probate is taking place in the designated section.

- Enter the date of death of the decedent in the correct format required by the form.

- Provide the name and address of the personal representative responsible for this estate.

- Enter the personal representative's Social Security number in the following field.

- Input the probate file number in the section provided.

- Fill out the personal representative's telephone number to ensure easy communication.

- Answer the question regarding whether a Federal 706 form was required. If 'yes,' you should not complete this form and should instead use form MI-706 or MI-706A.

- Enter the total value of the gross estate, ensuring that this is a true value based on IRS rules for estate tax, without estimating.

- Review and confirm the certification statement, where you declare the truthfulness of the information provided under penalty of perjury.

- Decide whether to authorize the Treasury to discuss your return with your preparer by selecting your preference.

- Finally, sign the form as the personal representative and indicate the date of signing before mailing it to the specified address.

- Once completed, you can save changes, download, print, or share the form as needed.

Complete your documents online today for a seamless submission experience.

O CFOP 2356 se refere a uma classificação fiscal que indica 'venda de mercadoria adquirida de terceiros'. Essa informação é essencial para o correto preenchimento de documentos fiscais e para a conformidade tributária. Usar o CFOP 2356 adequadamente pode ajudar sua empresa a evitar problemas legais. Além disso, plataformas como a US Legal Forms oferecem recursos para guiar você nessa questão, facilitando a compreensão das obrigações fiscais.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.