Loading

Get Form Et 14

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Et 14 online

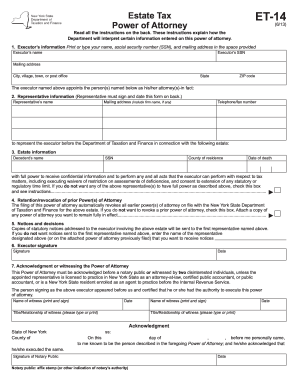

Filling out Form Et 14, the Estate Tax Power of Attorney, is an essential step in authorizing a representative to act on your behalf regarding estate tax matters. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to complete the Form Et 14 online successfully.

- Click the ‘Get Form’ button to obtain the form and open it in your browser.

- Fill in the executor's information by printing or typing your name, social security number (SSN), and mailing address in the designated spaces.

- Provide the representative's information, including their name, mailing address (including firm name if applicable), and telephone or fax number. Ensure the representative signs and dates the back of the form.

- Enter the estate information by detailing the decedent’s name, SSN, county of residence, and date of death. If you want to limit the authority of your representative, check the appropriate box.

- Complete the section regarding the retention or revocation of prior Powers of Attorney. Check if you do not wish to revoke any existing powers and attach necessary documents if applicable.

- Fill out the notifications and decisions section. Identify which representative should receive statutory notices regarding the estate.

- Sign and date the form as the executor. Be sure to attach proof of your authority to execute this power of attorney, such as the Letters Testamentary or Letters of Administration.

- Ensure all representatives sign and date the declaration section, indicating their qualifications to represent you before the Department of Taxation and Finance.

- Once all fields are completed, you may save your changes, download the form, and print it for submission as needed.

Complete your Form Et 14 online today to ensure timely and accurate representation of your estate matters.

Yes, you can file your taxes yourself in the USA. Many individuals choose to do it to save costs and gain a better understanding of their finances. Form Et 14 is a valuable resource that can help guide you step-by-step through the filing process, making it manageable and straightforward.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.