Loading

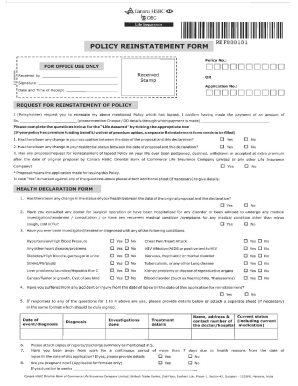

Get What Is The Reinstating Policy For Mutual Of Omaha

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the What Is The Reinstating Policy For Mutual Of Omaha online

Filling out the What Is The Reinstating Policy For Mutual Of Omaha online is a straightforward process. This guide will walk you through each step, ensuring you understand what information is required and how to complete the form accurately.

Follow the steps to complete the reinstating policy form with ease.

- Click the ‘Get Form’ button to access the document and open it in the online editor. This allows you to start filling out the form without any hassle.

- Begin by reviewing the form to familiarize yourself with its sections. This will help you understand what information you need to provide.

- Enter your full name in the designated field, ensuring that it matches the name on your Mutual Of Omaha policy documents.

- Provide your contact information, including your phone number and email address, to ensure you can be reached if necessary.

- Fill out the policy number related to the reinstatement you are requesting. Ensure that the information is accurate to avoid delays.

- Review any additional information requested, such as the reason for reinstatement. Be clear and concise in your explanations.

- Once all fields have been completed accurately, review the form for any errors or missing information.

- Save your changes and select the options to download, print, or share the completed form as needed.

Start filling out your forms online today to ensure your Mutual Of Omaha policy is reinstated smoothly.

The grace period for Mutual of Omaha life insurance typically spans 31 days after the premium due date. If a payment is made during this time, coverage remains intact without interruption. Understanding this grace period is crucial for maintaining your policy. Always check the specifics related to the reinstating policy for Mutual Of Omaha to stay informed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.