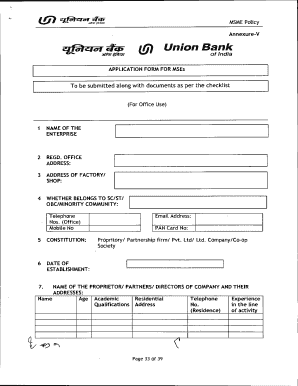

Get Mse Application Form - Union Bank Of India

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MSE Application Form - Union Bank Of India online

Filling out the MSE Application Form for Union Bank of India can be a straightforward process when approached step-by-step. This guide is designed to assist users, regardless of their prior experience, to accurately complete the form online.

Follow the steps to successfully complete your application online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the name of your enterprise in the designated field. Ensure that this matches the registered name of your business.

- Provide the registered office address in the next field. This is critical for the official documentation.

- Input the address of your factory or shop. This should be the location where business activities are conducted.

- Indicate whether your enterprise belongs to the SC/ST/OBC/minority community. Fill in the specific telephone and mobile numbers associated with your business.

- Specify the legal constitution of your business such as proprietary, partnership, limited company, or cooperative society.

- Enter the date of establishment of your business. This helps in determining your experience and operational history.

- List the names and addresses of the proprietors, partners, or directors of the company. Include their academic qualifications and relevant experience in the activity line.

- In the next section, detail your current and proposed business activities. Make sure to clarify if you are suggesting a different activity than previously stated.

- Identify any associate concerns and describe the nature of their association. Clearly detail your interest within those associates.

- Provide information regarding any existing credit facilities, detailing types, limits, and amounts. Certify that your unit has no outstanding loans from other banks.

- Outline the proposed credit facilities you are applying for, including the types of loans and their purposes.

- If applying for a term loan, provide details about the machinery required, including types and costs.

- List any collateral security being offered, if applicable, and include all relevant details.

- Complete the section regarding past financial performance and future estimates for your business.

- Ensure all statutory obligations are met, marking compliance with a yes or no, and explaining any not applicable situations.

- Affix required photographs and provide your signature indicating that all information supplied is true and correct.

- Attach all necessary documents as outlined, ensuring you check off items from the checklist provided within the form.

- Finally, review all filled sections for accuracy, then save your changes. You can download, print, or share the form as needed.

Complete your MSE Application Form online today and take the next step towards your business growth!

To enable SMS banking in Union Bank of India, simply visit the official website or your nearest branch for the application form. Follow the instructions to register your mobile number with the bank for secure banking transactions via SMS. Once activated, you will receive updates on your account and transactions, facilitating easier management of your finances, especially when applying for services like the MSE Application Form - Union Bank Of India.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.