Loading

Get Texas Home Equity Loan Application Fillable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Texas Home Equity Loan Application Fillable Form online

Filling out the Texas Home Equity Loan Application Fillable Form online can streamline your loan application process and ensure a secure submission. This guide will provide you with detailed instructions on navigating each section of the form effectively.

Follow the steps to complete your application with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

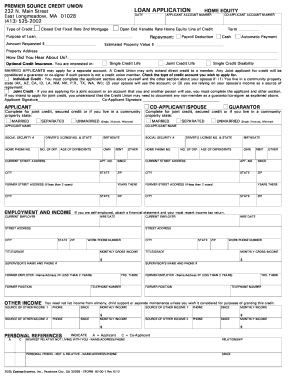

- Review the type of credit options available. You will need to select whether you are applying for a closed-end fixed-rate second mortgage or an open-end variable rate home equity line of credit.

- Fill out the 'Purpose of Loan' section. Indicate whether your intent is to pay off existing debt, purchase property, or a different purpose.

- Enter the 'Amount Requested' section with the specific amount of funds you wish to borrow, ensuring it aligns with Texas regulations.

- Provide your current property address, including the city, state, and zip code. Ensure that this matches the property title.

- Complete the sections for both the applicant and co-applicant, including their names, social security numbers, birthdates, and current addresses.

- Input employment and income details, including current employer's name, address, and monthly gross income. Include any other sources of income that you wish to disclose.

- Fill out the outstanding debts and other obligations section, detailing any existing debts and monthly payments that impact your creditworthiness.

- Review the personal references and provide the necessary details for at least one non-relative and nearest family member's contact information.

- Complete the government monitoring section if you choose to provide demographic information.

- Sign and date the application to certify that the information provided is accurate and truthful.

- Once you have filled out each section, save your changes, and download or print the completed form for your records or submission.

Start completing your Texas Home Equity Loan Application Fillable Form online today!

Yes, the Texas home equity affidavit and agreement must be recorded to finalize your loan. Recording this document ensures that it becomes part of the public record, providing legal protection for all parties involved. By using a Texas Home Equity Loan Application Fillable Form, you can streamline this process. It is crucial to follow local regulations to maintain valid claims on your property.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.