Get Sample Schedule C Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sample Schedule C Form online

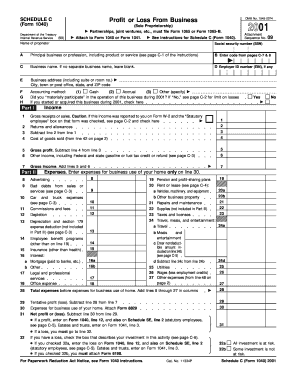

This guide provides a clear and supportive approach to completing the Sample Schedule C Form online, a valuable document for reporting profit or loss from business activities. Whether you are new to the process or looking for a concise reference, the following steps will help you navigate each section effectively.

Follow the steps to complete your Sample Schedule C Form online.

- Press the ‘Get Form’ button to access the form and open it in your document editor.

- In the first section, enter your name as the proprietor and your Social Security Number (SSN). Indicate your principal business or profession, along with the corresponding code derived from the provided pages.

- If applicable, fill in your business name, Employer Identification Number (EIN), and business address, ensuring to include your city, state, and ZIP code.

- Select your accounting method from the options: cash, accrual, or specify another method. Indicate whether you materially participated in the business during the year, and check the box if you started or acquired the business in the given year.

- Proceed to Part I to report your income. Start by entering your gross receipts or sales and the cost of goods sold if applicable. Calculate your gross profit by subtracting the cost of goods sold from your total income.

- In Part II, list your business expenses, which include various categories such as advertising, rent, wages, and supplies. Make sure to include only expenses that pertain to your business use.

- Calculate the total expenses and find your tentative profit or loss by subtracting total expenses from your gross income.

- If you have expenses for business use of your home, attach the necessary documentation and complete the corresponding section.

- Finally, document your net profit or loss and follow the instructions regarding your investment risk if applicable. Make sure to double-check all the information provided.

- Once all sections are complete, save your changes and download, print, or share the completed form as needed.

Start filling out your Sample Schedule C Form online today to ensure your business expenses and income are accurately reported.

Filling out a Schedule C may seem daunting at first, but it can be manageable with the right tools. Many find that a Sample Schedule C Form simplifies the process by providing a clear layout and guidance for entering information. With some preparation and attention to detail, you can complete this form smoothly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.