Get Irs Form 5129

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irs Form 5129 online

Filling out the Irs Form 5129 is an important step in managing your tax obligations. This guide will provide clear, step-by-step instructions to help you accurately complete the form online, ensuring that you fulfill your requirements with confidence.

Follow the steps to complete your Irs Form 5129 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

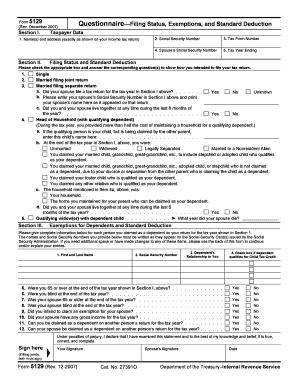

- In section I, provide your taxpayer data including your name(s) and address as it appears on your income tax return, your Social Security Number, and the tax year ending. Make sure to accurately fill in your spouse’s Social Security Number if applicable.

- Indicate your filing status by checking the appropriate box. Answer any relevant questions regarding your filing intentions and the status of your spouse if married.

- Move to section II and list each dependent you are claiming. Include their full names, Social Security Numbers, and their relationship to you. Double-check that this information matches what appears on their Social Security cards.

- Answer the exemption questions regarding your age, disability status, and whether your spouse qualifies for exemptions. These are crucial for determining your eligibility for certain deductions.

- Review your entries for accuracy. Ensure all required fields are complete. If necessary, use the back of the form for additional information or clarifications.

- Once you have filled out all sections, save your changes, and then you can choose to download, print, or share the completed form as necessary.

Start completing your Irs Form 5129 online today to ensure your tax filing is accurate and timely.

To fill out a form for a stimulus check, first determine if you qualify for the payment based on your financial situation. You may need to provide basic information such as your Social Security number, income details, and registration information. It’s crucial to keep track of deadlines and follow guidance from the IRS regarding eligibility. If you encounter challenges, USLegalForms offers helpful templates and tools to simplify the process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.