Get Statement Of Business Activities

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Statement Of Business Activities online

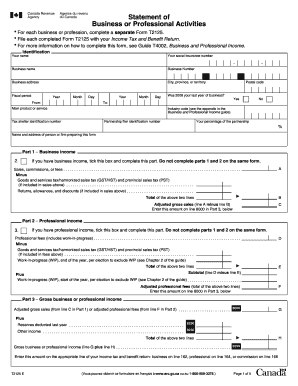

The Statement Of Business Activities is an essential document for individuals reporting their business income for tax purposes. This guide will provide clear, step-by-step instructions on how to complete the form online, ensuring accuracy and compliance.

Follow the steps to successfully complete your Statement Of Business Activities.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your identification information. This includes your name, social insurance number, business name, business number, and business address. Ensure that all details are accurate to avoid processing delays.

- Specify your fiscal period by entering the start and end dates. Indicate if 2008 was your last year of business by selecting 'Yes' or 'No'.

- In the 'Main product or service' section, describe the primary offerings of your business. Additionally, denote the industry code by referring to the appendix in the Business and Professional Income guide.

- If applicable, provide any tax shelter identification number and partnership filer identification number, including your percentage of the partnership.

- For Part 1 – Business income, check the box if you have business income. Enter total sales, commissions, or fees, followed by deductions for goods and services tax or harmonized sales tax included in the sales. Calculate adjusted gross sales and transfer this amount to the relevant line in Part 3.

- If applicable, complete Part 2 – Professional income by checking the box. Record professional fees and deductions for taxes included in the fees. Note total and adjusted fees, transferring this to Part 3 as well.

- Part 3 summarizes your gross business or professional income. Sum the adjusted business and professional incomes and enter the final amount in the appropriate section of your income tax return.

- Continue through the additional sections as necessary, detailing costs of goods sold, expenses, net income, and other relevant figures. Pay attention to ensure no applicable fields are omitted.

- Once all entries are completed and double-checked, you may proceed to save changes, download, print, or share the form as needed.

Take the necessary steps now to fill out your Statement Of Business Activities online and ensure compliance with tax regulations.

Business activities include any actions or operations that generate revenue. Common examples are selling products, providing services, or consulting. Each of these activities contributes to your Statement Of Business Activities and reflects your business's operational structure. Understanding different examples helps you accurately categorize your income and expenses.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.