Loading

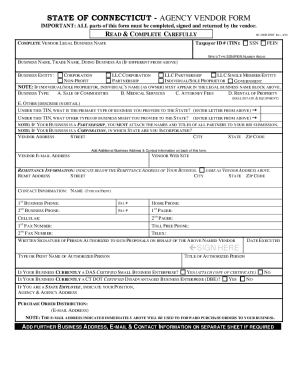

Get W 9 Form Ct

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W 9 Form Ct online

Filling out the W 9 Form Ct online can be a straightforward process if you follow the necessary steps. This guide will walk you through each component of the form, ensuring that you understand how to properly complete it in an online format.

Follow the steps to fill out the W 9 Form Ct online.

- Press the ‘Get Form’ button to access the W 9 Form Ct and have it open in your preferred editor.

- Begin by entering your legal name as it appears on your income tax return in the designated field. If you operate under a business name different from your personal name, include that in the business name section.

- Select the appropriate classification of your business by checking the box that corresponds to your entity type, such as Individual/Sole Proprietor, Corporation, or LLC.

- Input your Taxpayer Identification Number (TIN) in the specified area. If you are an individual, this will typically be your Social Security Number (SSN). If applicable, include your Employer Identification Number (EIN).

- Complete the address section by providing your current mailing address, including street, city, state, and zip code. This is essential for accurate communication.

- If you are claiming exemption from backup withholding, check the 'Exempt payee' box and provide any necessary details as per the instructions.

- Review all the information for accuracy and completeness before submitting. This includes confirming that your TIN matches the name provided to avoid any tax complications.

- After filling out all sections, save your changes using the Adobe Reader 'Save' function to ensure the information is not lost.

- You may now download, print, and share your completed form as required by the requester.

Complete your W 9 Form Ct online today to ensure a smooth process for your tax documentation.

Connecticut state tax forms can be accessed directly from the Connecticut Department of Revenue Services website. Many local tax offices also have state forms available. If you need convenience and a variety of forms, platforms such as US Legal Forms can help you easily find and download CT state tax forms like the W 9 Form Ct.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.