Loading

Get W 9 Form For At&t

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W 9 Form For At&t online

Filling out the W 9 Form is an essential step for individuals or businesses to provide their taxpayer identification information. This guide will walk you through the process of completing the W 9 Form for At&t online, ensuring you have the correct instructions at hand.

Follow the steps to complete the W 9 Form effectively.

- Press the 'Get Form' button to obtain the W 9 Form. This action will open the form in your preferred document editor, allowing you to start the filling process.

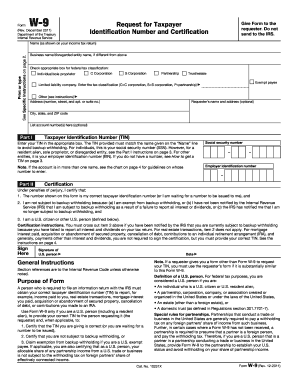

- Begin by entering your name as it appears on your income tax return in the designated field at the top of the form. If you are using a business name or disregarded entity name that differs from your personal name, please enter that information in the provided field as well.

- Next, check the appropriate box that corresponds to your federal tax classification. You may select from the following options: Individual/sole proprietor, C Corporation, S Corporation, Partnership, Trust/estate, Exempt payee, Limited liability company (indicate the tax classification), or Other.

- Fill in your full address, including the number, street, apartment or suite number, city, state, and ZIP code in the specified fields.

- In Part I, enter your Taxpayer Identification Number (TIN) in the appropriate box. If you are an individual, this will generally be your Social Security Number (SSN). If you are a business or entity, you will need to provide your Employer Identification Number (EIN). Make sure that the TIN you provide matches the name entered in the 'Name' section to avoid backup withholding.

- In Part II, review the certification statements. By signing the form, you certify that the information provided is accurate and that you are not subject to backup withholding, or you fulfill the necessary requirements to claim exemption from backup withholding.

- After completing all sections, sign and date the form where indicated. Ensure that your signature corresponds to a U.S. person, as defined in the form instructions.

- Finally, save your changes and choose to download or print the completed W 9 Form for your records. You can also share the form as required with the requester.

Take action now and complete your W 9 Form online for At&t to ensure smooth processing.

Typically, businesses or individuals that plan to make payments to contractors or freelancers should ask for a W 9 Form For AT&T. This form provides essential tax information necessary for reporting income to the IRS. If you're being hired for services, expect the requesting entity to ask you for a completed W 9.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.