Get Schedule 6a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule 6a online

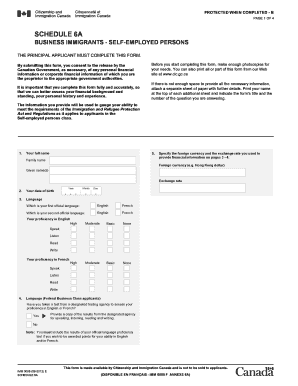

Filling out Schedule 6a is an essential step for applicants seeking to enter Canada as self-employed persons. This guide will provide you with clear and detailed instructions on how to complete the form accurately to support your application.

Follow the steps to successfully complete the Schedule 6a form online.

- Click ‘Get Form’ button to obtain the Schedule 6a document and open it in the editing tool.

- Provide your full name in the designated fields. Include both your family name and given names as they appear on your identification.

- Enter your date of birth in the specified format, including year, month, and day.

- Select your first and second official languages from the options given, indicating your proficiency level in speaking, listening, reading, and writing.

- For Federal Business Class applicants, indicate whether you have taken a language proficiency test. If yes, be prepared to provide the results.

- Detail your relevant experience over the past five years, focusing on self-employment in cultural activities, athletics, or farm management. Be ready to attach additional sheets if necessary.

- Indicate if you or your accompanying partner have completed a two-year program of full-time study at a post-secondary institution in Canada, and provide evidence if applicable.

- State if you or your accompanying partner have worked full-time in Canada. Again, evidence should be provided if applicable.

- Disclose if you have a relative living in Canada who holds citizenship or permanent residency, specifying their relationship to you.

- Describe the occupation you intend to pursue while self-employed, including details about the location and expected investment.

- Complete the personal net worth statement by listing all your assets and liabilities, ensuring to provide detailed information for each section.

- Summarize your financial resources in the accumulation of funds section by narrating how your available resources were amassed, being prepared to provide documentation if requested.

- Once completed, review all entries for accuracy. Save your changes, then download, print, or share the form as needed.

Complete your Schedule 6a online to streamline your application process.

Filing an entity classification election is crucial when you want to determine how your business will be taxed. Typically, you should file this election when you form your business or when there is a change in its ownership structure. Making timely decisions regarding classification ensures that your tax reporting aligns with IRS requirements, specifically with Schedule 6a guidelines. If you need assistance, US Legal Forms provides resources and templates to help simplify this process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.