Loading

Get Formulario 3911 Del Irs En Español

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Formulario 3911 Del Irs En Español online

Filling out the Formulario 3911 Del Irs En Español is an essential step for users who need to resolve issues related to their tax refunds. This guide provides clear instructions for completing the form online, ensuring a seamless experience.

Follow the steps to fill out your form accurately.

- Click ‘Get Form’ button to acquire the Formulario 3911 Del Irs En Español and open it in your editing tool.

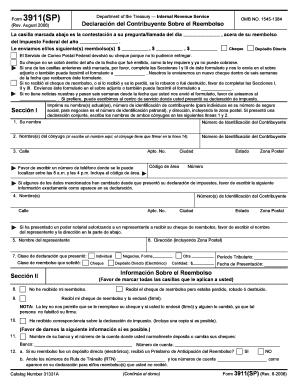

- In Section I, print your current name(s) and taxpayer identification number. For individuals, this is your social security number; for businesses, provide your employer identification number. Include your address in full, including a ZIP code.

- If filing jointly, enter both partners' names in lines 1 and 2, along with their identification numbers.

- Provide a contact phone number where you can be reached between 8 a.m. and 4 p.m., including the area code, and fill out your city and state information.

- If any personal information has changed since you filed your taxes, please provide that updated information exactly as it appears on your return.

- If you have authorized someone to receive your refund check, include their name and address as requested.

- Indicate the type of return you filed and the refund type you requested, marking all relevant boxes.

- In Section II, provide information regarding whether you have received your refund check, if it was lost, stolen, or destroyed.

- If applicable, provide your bank's name and the account number for where you usually deposit your checks.

- Complete Section III by signing the form where required. Ensure you sign as you did on your tax return.

- Finalizing your submission, check that all sections are filled accurately. Save your changes, download a copy, and print or share the completed form as necessary.

Complete your Formulario 3911 Del Irs En Español online to expedite your tax refund inquiry.

You should send Form 3911 to the IRS at the address specified in the instructions included with the form. If you are using the Formulario 3911 Del Irs En Espaol, the instructions will provide specific details on where to mail it. Sending the form to the right address is essential to ensure a timely response. Double-check for the latest information to avoid any mistakes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.