Loading

Get Sme Loan Application Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the sme loan application form online

Filling out the sme loan application form online is a straightforward process that requires your accurate information. This guide provides step-by-step instructions to help you complete each section of the form with confidence.

Follow the steps to successfully complete your application.

- Click the ‘Get Form’ button to access the application form and open it in your online editor.

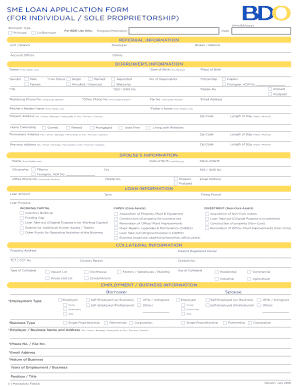

- In the borrower type section, select whether you are the principal borrower or will be a co-borrower. Provide the program or promotion you are applying under and fill in the date of application.

- Next, fill out the referral information, including the unit or branch, developer, account officer, and any broker or referrer details.

- In the borrower's information section, input your name (first, middle, last), gender, civil status, date of birth, place of birth, number of dependents, citizenship status, SSS/GSIS number, TIN, mobile number, office phone number, residence phone number, email address, fax number, and your parents' names.

- Provide your present address, home ownership status, length of stay, permanent address, and previous address as applicable.

- If applicable, include spouse's information, including their name, date of birth, citizenship, place of birth, TIN, SSS/GSIS number, office phone number, mobile number, and email address.

- In the loan information section, specify the loan amount, fixing period, term, and purpose of the loan by selecting from the predefined options.

- Provide collateral information, including property address, registered owner's name, type of collateral, and contact person's details.

- Detail the employment or business information for both borrower and spouse, including employment type, business type, employer's name and address, and nature of business.

- Fill out the income details for both borrower and spouse, specifying gross monthly income, other monthly income, and monthly expenses.

- Complete the financial information section by providing details on bank relationships, including deposits and loans.

- List trade references, including major customers and suppliers with their contact information.

- Review and agree to the undertaking section, ensuring you understand the commitments you're making and that your provided information is accurate.

- At the end of the form, sign and date where indicated, and ensure to have your spouse or co-borrower sign as required.

- After filling out all required fields, save changes, download, print, or share the form as needed.

Make sure to complete your application accurately and submit it online for prompt processing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To fill a loan application form correctly, read all instructions carefully. Provide clear and concise information, ensuring that all required fields are completed. A well-organized Sme Loan Application Form increases your chances of approval. For assistance, consider using resources from UsLegalForms to navigate this task smoothly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.