Loading

Get Form 318925

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 318925 online

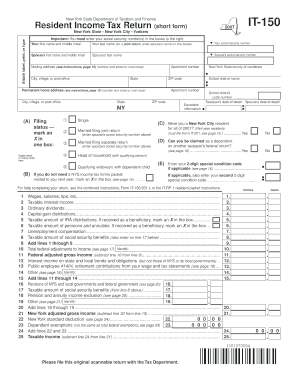

Filling out the Form 318925 online can streamline your tax filing process. This guide will walk you through each section and field of the form, ensuring you complete it accurately and efficiently.

Follow the steps to successfully complete Form 318925 online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by entering your personal information, including your first name, middle initial, last name, and social security number in the designated boxes. If filing jointly, provide your partner's details below yours.

- Fill in your mailing address accurately, ensuring all fields are completed, including apartment number, city, state, and ZIP code.

- Select your filing status by marking an X in the appropriate box. Options include single, married filing jointly, married filing separately, or qualifying widow(er) with a dependent child.

- Provide important information regarding residency by answering whether you were a New York City resident for the entire year and if you can be claimed as a dependent on another taxpayer's return.

- Enter your financial information including wages, salaries, taxable interest, and other requisite income sources. Make sure to total these amounts accurately as they will determine your federal adjusted gross income.

- Continue through the form by providing any applicable credits and deductions, such as the New York standard deduction and any dependent exemptions to calculate your taxable income.

- Complete the tax calculation sections, entering applicable lines for state and local taxes, and any amounts withheld.

- Review the refund or amount owed sections to ensure accurate calculations and decide on direct deposit options if applicable.

- Finalize by signing the form. Ensure both you and your partner (if applicable) provide your signatures and information, including occupation and date.

- Save your changes, download, or print the completed form before submitting it to the designated address provided in the instructions.

Complete your Form 318925 online now for a smoother tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Completing a W-8BEN E form involves providing accurate details about the entity receiving payments, such as its name, address, and tax identification number. This form is essential for foreign entities to claim reduced withholding rates. For assistance in completing this and other forms like Form 318925, visit US Legal Forms for user-friendly templates and resources.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.