Loading

Get Sample W9

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sample W9 online

Filling out the Sample W9 form is an essential step for individuals and organizations looking to do business with New York State. This guide provides a user-friendly, step-by-step process to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the Sample W9 form.

- Click the ‘Get Form’ button to access the Sample W9 form and open it in your preferred editing tool.

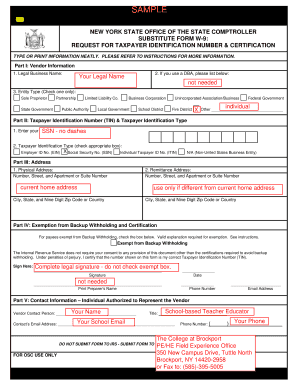

- In Part I, enter your legal business name. If you operate under a Doing Business As (DBA) name, include it in the provided space. Additionally, check the appropriate box to indicate your entity type from the listed options.

- In Part II, input your Taxpayer Identification Number (TIN) in the designated area, ensuring that no dashes are included. Then, check the box that corresponds to your taxpayer identification type: Employer ID Number (EIN), Social Security Number (SSN), or Individual Taxpayer ID Number (ITIN).

- In Part III, provide both your physical address and, if applicable, your remittance address. Ensure that all address details, including the city, state, and zip code, are accurate.

- In Part IV, indicate if you are exempt from Backup Withholding by checking the appropriate box, if applicable. You must then sign the form, print your name, enter the date, phone number, and email address.

- In Part V, provide the contact information for the individual authorized to represent your organization. This should include their name, title, email address, and phone number.

- After completing all sections, review the form for accuracy. Once confirmed, save your changes, and choose to download, print, or share the form as needed.

Complete your documents online today for streamlined processing.

The W-9 is not an international form but rather a document used specifically within the United States. It is designed for domestic tax identification and reporting purposes. For international transactions or foreign entities, the W-8 series forms are more appropriate, as they cater to non-resident individuals and foreign businesses.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.