Loading

Get Mo 941

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mo 941 online

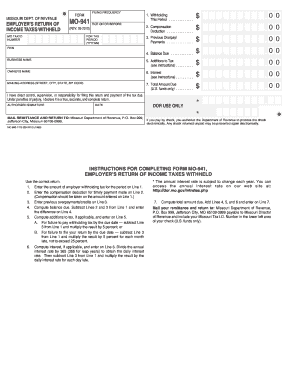

The Mo 941 is the employer's return of income taxes withheld in the state of Missouri. This guide provides step-by-step instructions to help users complete this form accurately and efficiently.

Follow the steps to successfully fill out the Mo 941 online.

- Press the ‘Get Form’ button to retrieve the form and display it in the online editor.

- Enter your Missouri tax ID number in the designated field at the top of the form.

- Indicate the tax period for which you are filing, using the format YYYY, MM.

- On Line 1, enter the total amount of employer withholding tax for the reporting period.

- On Line 2, specify the compensation deduction for timely payments made, which should correspond to the amount in Line 1.

- If applicable, enter previous overpayments or credits on Line 3.

- Calculate the balance due by subtracting the total from Lines 2 and 3 from Line 1; enter this figure on Line 4.

- If you owe additions to tax, compute them as described and enter the result on Line 5.

- Calculate any interest due on Line 6 using the daily interest rate based on the current annual interest rate, and submit this amount.

- On Line 7, add the amounts from Lines 4, 5, and 6 to determine your total amount due.

- Sign the form under the authorized signature section, affirming the accuracy of the information, and enter the date.

- Once the form is complete, you can save your changes, download it for your records, print a copy for submission, or share it as needed.

Complete your Mo 941 form online today to ensure timely filing and compliance.

To file the MO-941, complete the form either by hand or through an online platform. After filling the form, submit it along with your payment, if applicable, by mailing it to the designated address or by filing online. Ensuring that all entries are accurate will help you avoid issues with the state. For efficient filing, consider using services like USLegalForms to handle this process seamlessly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.