Loading

Get Employee Payroll Deductions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Employee Payroll Deductions online

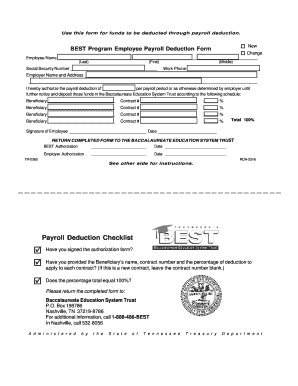

Filling out the Employee Payroll Deductions form online is a straightforward process that ensures your contributions are accurately deducted from your payroll. This guide will walk you through each section of the form to help you complete it with confidence and clarity.

Follow the steps to complete the Employee Payroll Deductions form online.

- Select the ‘Get Form’ button to access the Employee Payroll Deductions form and open it for editing.

- Begin by entering your personal information. Fill in your last name, first name, and middle name as requested in the designated fields.

- Next, provide your Social Security number in the corresponding section. This is crucial for identification and tax purposes.

- Input your work phone number to facilitate communication regarding your payroll deductions.

- In the employer name and address section, write down the full name and address of your employer accurately.

- Authorize the payroll deduction amount by completing the relevant section. Specify the amount to be deducted per payroll period or as determined by your employer.

- Indicate the beneficiaries for the deductions. Provide the name, contract number, and percentage of deduction for each beneficiary listed. Ensure that the total allocation sums up to 100%.

- Review all the information for accuracy before signing. Once confirmed, sign the form and include the date of signing.

- Complete any employer authorization requirements if applicable and print the form.

- Save your changes, and if necessary, download the form, print it, or share it as required. Finally, return the completed form to the Baccalaureate Education System Trust.

Complete your Employee Payroll Deductions form online today to ensure your contributions are accurately processed.

Various amounts can be deducted from payroll, including federal and state taxes, health insurance premiums, retirement plan contributions, and even union dues. Each deduction serves a specific purpose, benefiting both the employee and employer. Taking the time to learn about different Employee Payroll Deductions can help you plan your finances more effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.