Loading

Get Credit Reference

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Credit Reference online

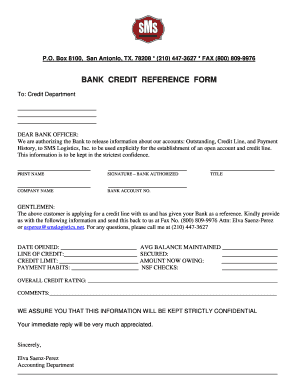

The Credit Reference form is essential for establishing a credit line with a vendor. This guide provides a clear and supportive approach to completing the form online, ensuring users can fill it out accurately and comprehensively.

Follow the steps to complete the Credit Reference form effectively.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Begin by providing the bank's name and contact details in the designated fields. This should include the name of the bank and any relevant contact information that identifies the financial institution.

- In the section addressed to the bank officer, clearly state your request for the bank to release account information. Input the name of the company requesting the credit reference, which is SMS Logistics, Inc.

- Below the authorization statement, provide the print name, signature, title, and company name of the authorized individual at the bank.

- Enter the bank account number associated with the account for which the reference is being provided.

- Fill in the requested information regarding the credit reference, including 'date opened,' 'average balance maintained,' 'line of credit,' 'secured' status, 'credit limit,' and 'amount now owing.' Ensure all entries are accurate to reflect the account's status.

- Provide information regarding payment habits and any NSF checks that may have been issued. These details help give a more complete picture of the client's creditworthiness.

- Complete the overall credit rating and any additional comments that may assist in the review process.

- Once all sections are filled out thoroughly, review your entries for accuracy and completeness.

- After final review, you can save changes, download the completed form, print it out, or share it as required.

Take the next step and complete the Credit Reference online today.

To obtain a credit reference, you can reach out to individuals or institutions familiar with your credit history. Start by asking past lenders, landlords, or even your personal connections if they would be willing to provide a reference. It’s helpful to explain why you need the reference and how it could benefit you in your financial endeavors. You can also provide them information on how they can best assist you.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.