Loading

Get What Does A State Tax Form Look Like

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the what does a state tax form look like online

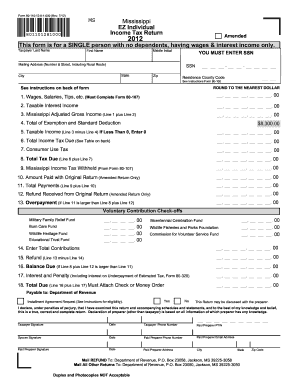

Filling out a state tax form online can seem daunting, but with the right guidance, it becomes a straightforward process. This guide will walk you through the specifics of completing the Mississippi EZ Individual Income Tax Return accurately and effectively.

Follow the steps to complete your tax form with ease.

- Click ‘Get Form’ button to access the form and open it for completion.

- Begin by entering your last name, first name, and middle initial in the appropriate fields. Make sure to input your social security number accurately in the designated area.

- Fill in your mailing address, including the number and street, city, state, and zip code.

- List your wages, salaries, tips, and any taxable interest income in lines 1 and 2 respectively. Ensure amounts are rounded to the nearest dollar.

- Calculate your Mississippi adjusted gross income by adding the amounts from line 1 and line 2, and enter this total on line 3.

- On line 4, enter the total amount of your exemption and standard deduction, which is $8,300 for this form.

- Determine your taxable income by subtracting line 4 from line 3 and enter the result on line 5. If this result is less than zero, enter zero.

- Refer to the tax table provided in the instructions to calculate the total income tax due on line 6. Enter your total here.

- If applicable, enter the amount of consumer use tax on line 7. Add lines 6 and 7 together and enter the result on line 8.

- Record any Mississippi income tax withheld as shown on Form 80-107 on line 9.

- If filing an amended return, enter the original payment amount on line 10.

- Calculate total payments by adding lines 9 and 10, and write the total on line 11.

- Complete line 12 only if you received a refund from your original return (for amended returns).

- Determine any overpayment by assessing if line 11 exceeds the total of line 8 plus line 12, and record on line 13.

- If you wish to make voluntary contributions, enter those amounts in the various check-off funds provided.

- Compute the refund (if applicable) by subtracting line 14 from line 13 on line 15. Enter any additional balance due on line 16.

- If paying after the due date, calculate interest and penalty on line 17.

- Finalize your form by calculating the total amount due on line 18, which you must submit along with your payment.

- Review the form for accuracy, sign where indicated, and provide any necessary contact information before saving, downloading, printing, or sharing the completed form.

Complete your state tax forms online for a hassle-free filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To fill out a tax withholding form properly, first review your expected income and tax deductions. Next, follow the form's instructions to claim the correct number of allowances. Understanding what a state tax form looks like helps you fill it out accurately. Look to platforms like US Legal Forms for templates and guides tailored to your situation.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.