Loading

Get Cash Count Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cash Count Form online

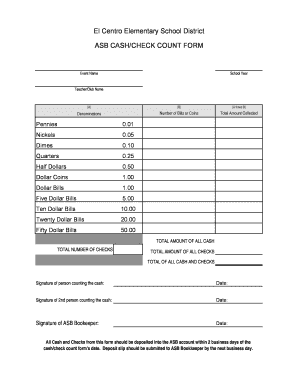

This guide provides detailed instructions for completing the Cash Count Form online. By following these steps, you can ensure accurate documentation of cash and checks collected during events.

Follow the steps to fill out the Cash Count Form successfully

- Click ‘Get Form’ button to obtain the Cash Count Form and access it in the designated editor.

- Begin by entering the event name in the provided field to identify the occasion for which the funds were collected.

- Fill in the school year to help organize the records appropriately.

- In the section labeled ‘Teacher/Club Name,’ input the name of the teacher or club associated with the event.

- Now, for each denomination of currency listed, enter the number of bills or coins collected in the corresponding field. The denominations include pennies, nickels, dimes, quarters, half dollars, dollar coins, and various dollar bill amounts.

- Calculate the total amount collected for each denomination by multiplying the number of bills or coins by their respective values. Input these totals in the designated area.

- Once all totals are calculated, proceed to sum the total amount of all cash collected and enter this figure in the appropriate field.

- Fill out the total number of checks received as well as the total amount of all checks in their respective fields.

- Add together the total of all cash and checks collected, and record this final amount.

- Sign your name in the signature line for the person counting the cash and include the date of the count.

- If a second person is involved in the count, they should sign and date in their designated areas as well.

- Lastly, have the ASB Bookkeeper sign and date the form to complete the documentation.

- After filling out the form, you can save your changes, download a copy, print it for your records, or share it as needed.

Complete your documents online to ensure timely processing.

To show proof of cash, it is essential to provide a clear record of cash transactions. A Cash Count Form serves as a reliable document that tracks cash inflows and outflows, providing a comprehensive overview of your cash position. You can create your own cash count form or utilize features available on platforms like US Legal Forms for a structured approach.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.