Get Form C

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form C online

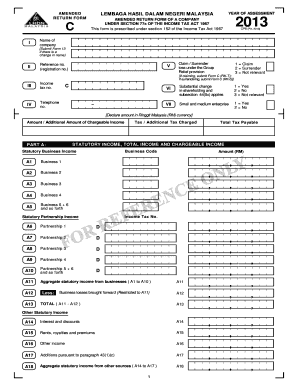

Filling out the Form C online can seem overwhelming, but with this comprehensive guide, you will find a clear path to completing the form accurately. This guide is designed to help users at all levels of experience navigate the form's components and requirements.

Follow the steps to effectively fill out the Form C.

- Click the 'Get Form' button to obtain the form and open it in your editor.

- Enter the name of your company in the designated field. If there has been a change in name, ensure to submit Form 13 as well.

- Input your reference number, which serves as your registration number for the company.

- Fill in the income tax number assigned to your company. Ensure this number is correct to avoid issues with submission.

- Provide your current telephone number for any necessary correspondence related to the form.

- Indicate the year of assessment for which you are submitting the amended return.

- For section VI, select whether you are claiming or surrendering loss under the Group Relief provision using the provided options.

- Indicate whether there has been a substantial change in shareholding and whether your company qualifies as a small and medium enterprise.

- In Part A, enter the statutory business income amounts for each business under your company’s operation, ensuring to enter them in Ringgit Malaysia (RM).

- Continue filling out the details regarding other sources of statutory income and deductions, maintaining accuracy in all numeric entries.

- Complete the declaration section by affirming that the provided information is true and correct, and ensure the form is signed and dated.

- Upon final review, save your changes, and choose to download, print, or share the completed form as required.

Start filling out your Form C online today to ensure timely compliance with tax obligations.

You can get the 1095-C form online by accessing your employer’s benefits portal or directly from the IRS website. This form provides important information about your health coverage, allowing you to determine if you are eligible for certain tax credits. If your employer does not provide online access, you may ask them for a copy. Consider using US Legal Forms for guidance on how to manage your documentation effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.