Loading

Get Healthequity Distribution Of Excess Hsa Contribution Form 2012-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HealthEquity Distribution Of Excess HSA Contribution Form online

This guide provides clear instructions on how to accurately complete the HealthEquity Distribution Of Excess HSA Contribution Form online. By following these steps, users will ensure that their excess contributions are processed correctly and efficiently.

Follow the steps to complete the form online effortlessly.

- Click the ‘Get Form’ button to access the form and open it in an online editor.

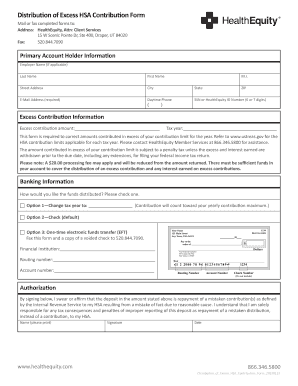

- Begin by filling out the Primary Account Holder Information. This section requires the employer name (if applicable), last name, first name, street address, city, state, ZIP code, email address, daytime phone number, and Social Security Number (or HealthEquity ID number). Ensure all fields marked as required are completed.

- In the Excess Contribution Information section, indicate the excess contribution amount and the tax year for which the contribution was made. Remember to verify the applicable contribution limits for the current tax year from the U.S. Treasury website.

- Select how you would like the excess funds to be distributed. You have three options: Option 1 (Change tax year), Option 2 (Check, which is the default), or Option 3 (One-time electronic funds transfer). Ensure you select the appropriate option.

- If you choose Option 3, provide the necessary banking information, including your financial institution's name, routing number, and account number. Additionally, fax this form along with a voided check to the specified number.

- In the Authorization section, print your name, sign the form, and provide the date. Review your responses for accuracy before submitting.

- Once you are satisfied with the completed form, you can save your changes, download or print a copy for your records, or share it as needed.

Complete your HealthEquity Distribution Of Excess HSA Contribution Form online today for a seamless experience.

To find your HSA distribution, check your annual statements or Form 1099-SA from your HSA provider. This document summarizes all distributions made during the tax year and can help clarify your financial situation. For adjustments related to excess contributions, refer to your HealthEquity Distribution Of Excess HSA Contribution Form as a reliable resource.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.