Loading

Get 401c

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 401c online

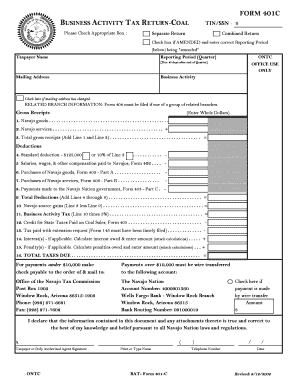

Filling out the 401c online is an important step for businesses involved in coal activity within the Navajo Nation. This guide provides detailed, step-by-step instructions to help users accurately complete the form with confidence.

Follow the steps to successfully fill out the 401c online.

- Click ‘Get Form’ button to obtain the 401c form and open it in your preferred online editor.

- Begin by selecting the appropriate box indicating whether you are filing a separate or combined return. Ensure that you check the amended box if you are correcting a prior filing.

- Enter your taxpayer identification number (TIN) or social security number (SSN) in the designated field.

- Provide the taxpayer name as it appears on official documents, followed by your mailing address. If your mailing address has changed, check the corresponding box.

- Select the reporting period for which you are filing. Remember that this form is due 45 days after the end of the quarter you are reporting.

- In the 'Business Activity' section, describe the nature of your business operations.

- Fill in the gross receipts. Enter your total receipts from Navajo goods and services in the relevant fields and calculate the total gross receipts.

- Complete the deductions section by entering the standard deduction, salaries and wages paid to Navajos, and any purchases related to Navajo goods and services. Sum these values to determine total deductions.

- Calculate your Navajo source gains by subtracting total deductions from total gross receipts.

- Calculate the business activity tax by applying the 5% rate to line 10.

- If applicable, enter any credits for state taxes paid on coal sales and any taxes paid with extension requests.

- If interested or applicable, calculate any penalties or interest owed based on your situation and include these values.

- Sum all taxes due, ensuring that all calculations are checked for accuracy.

- For payments under $10,000, follow the instructions to prepare your check. For payments over $10,000, wire transfer instructions must be followed.

- Review the declaration section, ensuring that you and any authorized agents sign where required and provide the necessary contact information.

- Once completed, save your changes and download, print, or share the form as necessary to submit it.

Start filling out your 401c form online today for a seamless reporting experience.

An example of a 401k is a company-sponsored retirement plan that allows employees to contribute a portion of their salary into individual accounts. For instance, if you work for a company that offers a matching contribution, every dollar you put in may be matched up to a certain percentage by your employer. This creates an immediate boost to your retirement savings within your 401c, making it a beneficial choice for many.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.