Loading

Get 2004 1040 Schedule C Pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2004 1040 Schedule C Pdf online

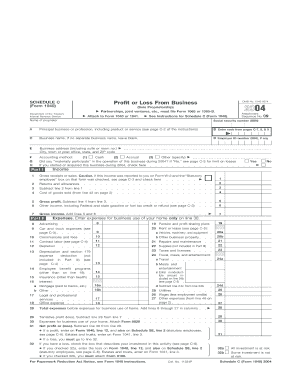

Filling out the 2004 1040 Schedule C is an essential task for self-employed individuals filing their taxes. This guide will walk you through each section of the form, ensuring you accurately complete it online.

Follow the steps to fill out the form effectively.

- Click ‘Get Form’ button to obtain the 2004 1040 Schedule C Pdf and open it in your preferred PDF editor.

- Begin by entering your name in the 'Name of proprietor' field and your Social Security number (SSN) in the designated area.

- In the 'Principal business or profession' section, describe your primary business activities and refer to the provided code list to select the appropriate business code.

- If you have a separate business name, enter it in the 'Business name' field; otherwise, leave it blank.

- Fill in your business address, including the suite or room number, city, state, and ZIP code.

- Indicate your accounting method by checking the appropriate box: cash, accrual, or other.

- Answer whether you materially participated in the business during 2004 by selecting 'Yes' or 'No.' If applicable, indicate if you started or acquired the business this year.

- Proceed to Part I, where you will enter your gross receipts or sales as well as any returns and allowances. Calculate your gross profit by subtracting the returns from total sales.

- In Part II, detail your business expenses. Start by filling in each relevant expense category with the corresponding amounts.

- Conclude by calculating your net profit or loss in Part III. If you have a profit, report it on the designated lines for Form 1040 and Schedule SE.

- Finally, ensure all your entries are accurate. Save your changes, download, print, or share the completed form as needed.

Start preparing your 2004 1040 Schedule C online today.

To prove your Schedule C income, you should maintain clear records of all business transactions, including invoices, receipts, and bank statements. This documentation will support the figures reported on your 2004 1040 Schedule C Pdf and help in case of an audit. Using accounting software can also streamline record-keeping and enhance accuracy.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.