Loading

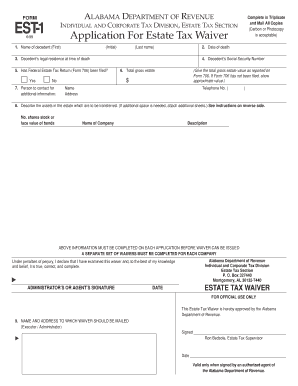

Get Alabama Inheritance Tax Waiver Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Alabama Inheritance Tax Waiver Form online

Filling out the Alabama Inheritance Tax Waiver Form is essential for the smooth transfer of assets after a person's passing. This guide provides detailed, step-by-step instructions to help users navigate the online process efficiently and accurately.

Follow the steps to complete the form correctly and effortlessly.

- Press the ‘Get Form’ button to access the Alabama Inheritance Tax Waiver Form and open it in your preferred online editor.

- In the first section, enter the name of the decedent, specifying the first name, middle initial, and last name.

- Provide the date of death of the decedent in the designated field.

- Input the decedent's legal residence at the time of their death.

- Include the decedent’s Social Security number for identification.

- Indicate whether a Federal Estate Tax Return (Form 706) has been filed by selecting 'Yes' or 'No'.

- Enter the total gross estate value as reported on Form 706 if applicable, or provide an approximate value if Form 706 has not been filed.

- Designate a person for additional information by entering their name, telephone number, and address.

- Describe the assets in the estate that are to be transferred by listing relevant details for each type of asset, such as stocks, bonds, annuities, life insurance policies, or real property. Make sure to include examples and necessary specifics to ensure clarity.

- Complete the name and address field to indicate where the waiver should be mailed once processed.

- Lastly, ensure to sign the application, indicating the date to certify the accuracy of the information provided.

Get started now and complete your Alabama Inheritance Tax Waiver Form online!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To avoid estate taxes in Alabama, consider strategic estate planning, such as gifting assets during your lifetime or setting up trusts. These methods can effectively reduce the taxable value of your estate. Additionally, ensuring that you complete the Alabama Inheritance Tax Waiver Form can help affirm that your estate is compliant with state tax laws.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.