Get Nj Inheritance Tax Waiver

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nj Inheritance Tax Waiver online

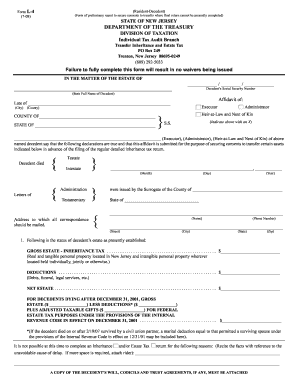

Filing the Nj Inheritance Tax Waiver online is an important step for individuals managing the estate of a deceased person in New Jersey. This guide provides clear, step-by-step instructions to help you navigate the process with confidence, ensuring that all required information is accurately completed.

Follow the steps to successfully complete the Nj Inheritance Tax Waiver online.

- Press the ‘Get Form’ button to obtain the Nj Inheritance Tax Waiver form, which you will open in your preferred online editor.

- Begin by entering the decedent's full name and social security number at the top of the form, ensuring this information is accurate to avoid delays.

- Indicate whether the decedent died testate or intestate by checking the appropriate box.

- Provide the date of death using the month, day, and year format. Ensure that this is correctly filled to reflect the date when the decedent passed.

- List the executor or administrator’s information, including their address, phone number, and the county and state where they are located.

- Complete the financial details regarding the decedent's estate. Fill in the gross estate, deductions, and net estate amounts accurately. Note that this information is crucial for tax calculation.

- If applicable, provide a brief explanation of why the full inheritance and estate tax return cannot be completed at this time, including any unavoidable causes that resulted in the delay.

- If there were significant transfers of the decedent's estate made before death, detail these transfers, including the names and relationships of the transferees. If no such transfers occurred, simply state "NONE".

- List all real estate owned by the decedent in New Jersey, providing assessed and market values, as well as any encumbrances.

- Enter details about any stocks, bonds, and brokerage accounts registered in the decedent's name, including company names and market values.

- Detail any funds in banks in New Jersey that were in the decedent's name, specifying the bank name, balance at the time of death, and current balance.

- Identify the surviving individuals who are entitled to share in the estate, providing their names, addresses, and relationships to the decedent.

- Indicate the items for which tax waivers are being requested, ensuring to provide any necessary supporting information if assets require custodial release.

- After completing all sections, review the form for accuracy, then save changes, download, or print a copy as needed. Share the form with any required parties.

Take the first step in managing estate affairs by completing the Nj Inheritance Tax Waiver online today.

Get form

New Jersey officially phased out its estate tax on January 1, 2018. This change has significantly impacted estate planning strategies for residents. However, it’s important to note that while the estate tax is gone, the Nj Inheritance Tax remains. For help navigating these changes and understanding your tax liabilities, consider utilizing services from US Legal Forms for accurate information and assistance.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.