Get Form 20 F Kvat

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 20 F Kvat online

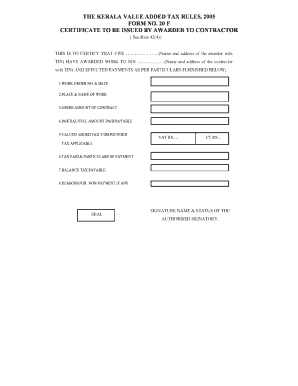

Filling out the Form 20 F relates to the issuance of a certificate by the awarder to a contractor under the Kerala Value Added Tax rules. This guide will provide you with clear and supportive instructions on how to complete this form online.

Follow the steps to fill out the Form 20 F Kvat online

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Review the introductory section of the form, which typically requires you to enter the name of the contractor and details of the contract. Ensure accuracy to prevent any processing delays.

- Fill in the details related to the awarder by providing their name, address, and relevant identification numbers as required. Double-check this information for correctness.

- Enter the contract value and the tax amount applicable as per the conditions of the agreement. Make sure to reference any supporting documents you have.

- Complete any additional sections that may apply to specific circumstances, such as alterations or amendments to the contract. Follow any specific guidelines provided within these sections.

- Review the entire form for completeness and accuracy. Ensure all required fields are filled out properly.

- Once finalized, save your changes. You may also download, print, or share the form as needed for your records or submissions.

Take action now and complete your Form 20 F Kvat online.

Form 20-F is used primarily to provide a comprehensive view of a foreign private issuer's financial health and operational practices to U.S. investors. This form includes critical financial statements, management analysis, and insights into governance. By completing Form 20-F, companies can enhance their credibility and attract investment. Thus, mastering the Form 20 F Kvat ensures that your company remains competitive and compliant in the U.S. market.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.