Get Sole Proprietor Profit And Loss Statement Template

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sole Proprietor Profit And Loss Statement Template online

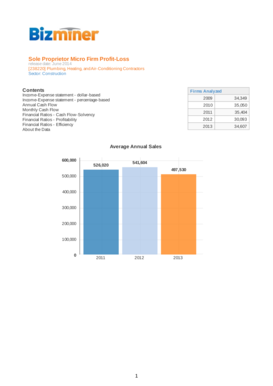

Filling out the Sole Proprietor Profit And Loss Statement Template is essential for summarizing your business's financial performance. This guide will provide you with step-by-step instructions to accurately complete the form online, ensuring you can track your income and expenses effectively.

Follow the steps to complete your profit and loss statement.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your business name and contact information in the designated fields. This information will help identify your business on the statement.

- In the income section, input all sources of revenue generated during the reporting period. Be sure to include gross sales and any additional income.

- Proceed to the expenses section, where you will enter all operational costs. Break down each expense category such as rent, utilities, salaries, and advertising.

- Calculate your gross profit by subtracting the total expenses from total income. This figure offers insight into your business's profitability before other costs.

- In the net profit section, include any taxes paid and other deductions to calculate your final profit. This amount signifies the actual income after all expenses.

- Review all entered information for accuracy, making corrections where necessary. Ensure all values are clear and properly calculated.

- Once you have completed all sections, you have options to save your changes, download the completed form, print it for records, or share it directly as needed.

Start completing your Sole Proprietor Profit And Loss Statement Template online today to streamline your financial management.

Profits and losses from a sole proprietorship are reported on the individual's tax return, often using Schedule C. This section details your business earnings, expenses, and net profit or loss, which directly affects your taxable income. Utilizing a Sole Proprietor Profit And Loss Statement Template can facilitate this process by providing a clear record of financial activities throughout the year. Accurate reporting is critical for compliance and understanding your business's financial health.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.