Loading

Get Certificate Of Fiscal Residence Israel

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Certificate Of Fiscal Residence Israel online

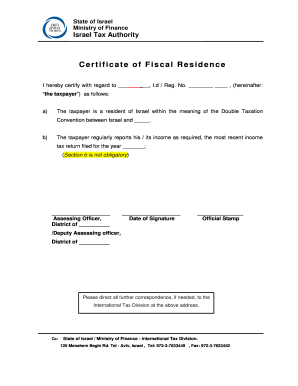

The Certificate Of Fiscal Residence Israel is an essential document for taxpayers seeking to confirm their tax residency status. This guide provides clear and detailed instructions on how to accurately complete this certificate online.

Follow the steps to fill out the Certificate Of Fiscal Residence Israel online.

- Press the ‘Get Form’ button to access the Certificate Of Fiscal Residence form and open it in your preferred document editor.

- In the first blank field, enter the name of the taxpayer for whom the certificate is being issued. Ensure that the spelling is accurate, as this is a legal document.

- In the second blank field, write the identification number or registration number of the taxpayer. This can be an ID number or a tax identification number.

- In section (a), indicate the statement confirming the taxpayer's residency in Israel according to the Double Taxation Convention. You may need to specify the country relevant to the convention.

- If applicable, in section (b), provide details regarding the taxpayer’s income reporting. Include the year for which the most recent income tax return has been filed. This section is optional but beneficial.

- Leave space for the Assessing Officer's details. This section will be filled out by the relevant government authority and should not be completed by the taxpayer.

- Ensure to leave the date of signature blank for the Assessing Officer to fill. This date will signify when the certificate is officially completed.

- Check the document for accuracy and completeness. Once confirmed, save your changes, download the document, or choose to print or share it as needed.

Start completing your Certificate Of Fiscal Residence online today!

Yes, tax residents in Israel are generally required to file an annual tax return, declaring their worldwide income to the Israeli tax authorities. This also applies to foreign income if you are a tax resident. Ensuring you have a Certificate Of Fiscal Residence Israel may simplify this process and provide clarity on your obligations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.