Loading

Get Ulbhry

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ulbhry online

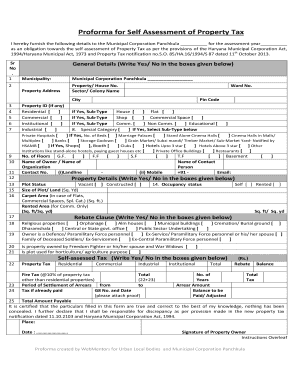

The Ulbhry is a vital document for the self-assessment of property tax in accordance with municipal regulations. This guide provides you with a clear understanding of how to complete the Ulbhry accurately and efficiently.

Follow the steps to complete the Ulbhry form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in the general details section, which includes the municipality, property address, and property ID if applicable. Make sure to indicate whether the property is residential, commercial, or institutional by checking the appropriate boxes.

- Provide details on the type of property and its specific subtype, such as house, flat, shop, or other categories based on the property classification.

- Complete the section regarding special categories if applicable, including details about specific institutions like hospitals, cinema halls, or hotels. Fill in the number of floors and the owner's contact information, ensuring accuracy.

- In the property details section, specify the plot status (vacant or constructed) and provide measurements for the size of the plot, carpet area, and rented area if applicable.

- Indicate the occupancy status, whether self-occupied or rented, to establish the correct property usage.

- Address the rebate clause by marking yes or no in the available boxes for various property types and statuses as outlined in the form.

- Calculate and fill out the self-assessed tax section for residential, commercial, industrial, and institutional properties, ensuring all amounts are properly totaled.

- Attach any proof of previous tax payments, if applicable, and note the balance payable.

- Once all sections are complete and verified for accuracy, save your changes. You may also download, print, or share the form as needed.

Complete your Ulbhry form online to ensure timely submission.

To fill property tax online for Haryana, visit the official ULB Haryana website. You will need to enter details about your property, such as ownership information and property location. After completing the necessary fields, review your entries and submit your payment. For any complex inquiries or forms, consider using solutions like USLegalForms to find tailored resources.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.