Loading

Get Ir433

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ir433 online

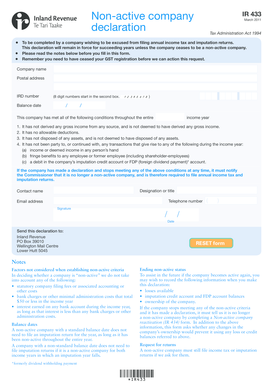

The Ir433 form is a declaration used by companies wishing to be excused from filing annual income tax and imputation returns. This guide provides step-by-step instructions to help you fill out the form accurately and efficiently.

Follow the steps to complete the Ir433 form online.

- Click the ‘Get Form’ button to download the Ir433 form and open it in your preferred editor.

- Fill in the company name in the designated field. Ensure that this matches the legal name of the company as registered.

- Enter the postal address for the company in the respective section. This should be the address where official correspondence can be sent.

- Input the IRD number. This is an 8-digit number that must start in the second box. Ensure it is accurate as this is essential for processing the declaration.

- Specify the balance date of the company. This is important as it determines the reporting period.

- Indicate whether the company has met all the specified conditions for being considered non-active throughout the income year by checking the corresponding boxes.

- Provide the designation or title of the person completing the form in the designated field.

- Fill in the contact name, telephone number, and email address of the person responsible for any follow-up communication.

- Sign and date the form. Ensure that the date is accurate to avoid any processing delays.

- After reviewing the completed form for accuracy, save your changes and choose to download, print, or share the form as needed.

Complete your non-active company declaration online to ensure compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Filling out a third-party authorization form requires you to provide details about both the third party and the reasons for authorization. It is essential to specify what permissions you are granting clearly. Ir433 can assist you in outlining the necessary information in an efficient manner.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.