Loading

Get Form 668 A

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 668 A online

Filling out the Form 668 A online is a straightforward process that requires careful attention to detail. This guide will provide you with essential steps and tips to successfully complete the form, ensuring you meet all necessary requirements.

Follow the steps to fill out Form 668 A accurately.

- Press the ‘Get Form’ button to access the Form 668 A online and open it in your preferred editor.

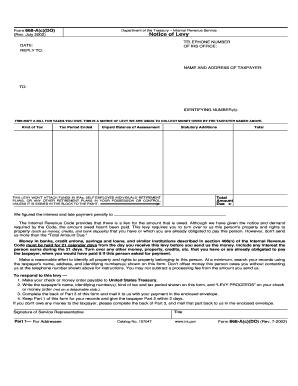

- Begin by entering the telephone number of the IRS office in the provided space. This number should be clearly indicated on the form.

- Fill in the date on which you are completing the form. Ensure that you use the correct format, typically MM/DD/YYYY.

- Provide the name and address of the taxpayer. Make sure this information matches your records to avoid any discrepancies.

- Enter the identifying number(s) related to the taxpayer. This could be their Social Security number or Employer Identification Number (EIN).

- Indicate the kind of tax related to the levy. Be clear about the specific tax type for accuracy.

- Document the tax period ended by specifying the last date of the relevant tax period.

- List the unpaid balance of the assessment, along with any statutory additions that apply, to accurately reflect the total amount due.

- Review the section that states which funds the levy will not attach to, such as IRA accounts, and mark it clearly, if applicable.

- Complete the payment instructions section if you are ready to submit a payment, ensuring your check or money order is made payable to United States Treasury.

- On the back of Part 3 of the form, fill in any necessary details and mail it to the IRS with your payment. Retain Part 1 for your records and provide Part 2 to the taxpayer within two days.

- If you do not owe any money to the taxpayer, complete the back of Part 3 indicating this and send it back in the enclosed envelope.

- Once completed, save your changes, download, print, or share the form as needed.

Complete your Form 668 A online today to ensure accurate processing.

To fill out an income tax return form, start by writing your personal information at the top of the form. Report your income, deductions, and any tax credits you may qualify for, ensuring accuracy and completeness. If you have tax liens, like those represented by Form 668 A, consider seeking guidance to navigate this process smoothly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.