Loading

Get Nys Enhanced Star Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nys Enhanced Star Form online

This guide provides clear and step-by-step instructions on how to complete the Nys Enhanced Star Form online, ensuring you understand each section and field required for your application. Follow these instructions to successfully submit your application for school tax relief.

Follow the steps to complete the form online:

- Press the ‘Get Form’ button to obtain the form and open it in your online editor.

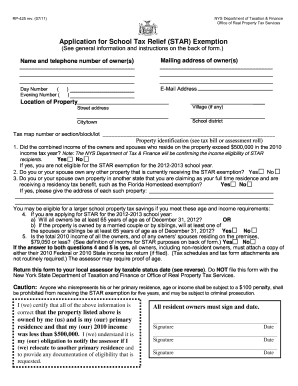

- Fill in the name and telephone number of the owner(s), along with their mailing address. Make sure to provide both a day and evening contact number.

- Input the location of the property by providing the street address, village (if applicable), city/town, school district, and tax map number or section/block/lot.

- Indicate whether the combined income of the owners and spouses who reside on the property exceeded $500,000 for the 2010 income tax year by selecting 'Yes' or 'No'.

- Answer whether you or your spouse own any other property that is currently receiving the STAR exemption by selecting 'Yes' or 'No'.

- Specify if you or your spouse own property in another state receiving residency tax benefits by answering 'Yes' or 'No.' If 'Yes', provide the address of each such property.

- For applicants applying for the Enhanced STAR exemption, indicate if all owners will be at least 65 years of age as of December 31, 2012, or if at least one married spouse or sibling meets this age criterion.

- Confirm if the total 2010 income of all owners and any spouses residing on the premises is $79,050 or less by answering 'Yes' or 'No.' Attach the required tax return documents if applicable.

- Certify that all the listed information is correct and that the property is the primary residence. All resident owners must digitally sign and date the form.

- After completing the form, save your changes, then download or print the completed document for submission to your local assessor by the taxable status date.

Complete your Nys Enhanced Star Form online today to secure your eligibility for tax relief.

Enhanced STAR provides an increased benefit for the primary residences of senior citizens (age 65 and older) with qualifying incomes: $92,000 or less for the 2022-2023 school year, $93,200 or less for the 2023-2024 school year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.