Loading

Get Tax Exempt Form Va

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Exempt Form Va online

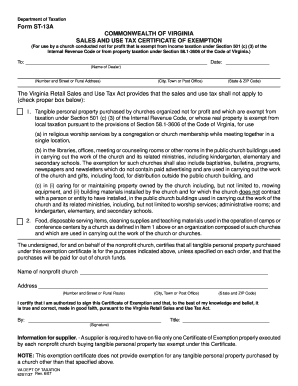

Filling out the Tax Exempt Form Va is an essential process for nonprofit churches seeking to obtain sales and use tax exemptions. This guide will walk you through each section of the form in a clear and user-friendly manner.

Follow the steps to complete the Tax Exempt Form Va online.

- Press the ‘Get Form’ button to access the Tax Exempt Form Va and open it in your preferred editor.

- Enter the name of the dealer in the designated field, along with their complete address including the number, street, city, and state with the ZIP code. Ensure all information is accurate for proper identification.

- Select the applicable box for the type of exemption being claimed. This could be for tangible personal property used by the church in various activities such as services or maintenance.

- For the certification section, provide the name and address of the nonprofit church in the specified fields. Make sure to include the complete address with number, street, city, and ZIP code.

- Sign the form where indicated, certifying that you are authorized to do so. Fill in your title to complete this section.

- Review all entries for accuracy before finalizing. After confirming all information is correct, you can save changes, download, print, or share the completed Tax Exempt Form Va online.

Complete your Tax Exempt Form Va online today for smooth and efficient processing.

Filling out exemptions on Tax Exempt Form VA 4 requires you to assess your financial situation. Determine how many exemptions you qualify for and note them in the designated section. Make sure to review relevant guidelines to identify any additional forms or documentation needed. This careful preparation helps avoid delays and ensures you take full advantage of your exemption status.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.