Loading

Get S15 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the S15 Form online

Filling out the S15 Form online can be a straightforward process when you know what to do. This guide provides step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the S15 Form online.

- Click the ‘Get Form’ button to obtain the form and open it in the online editor.

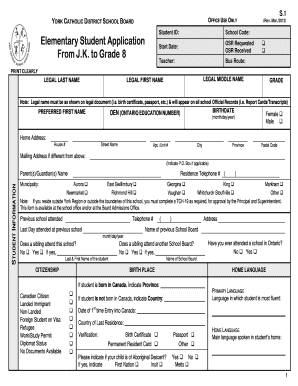

- Begin by entering the student’s legal names in the corresponding fields: Legal last name, legal middle name, and legal first name. Ensure that the names are exact as per legal documents such as a birth certificate.

- Fill in the date of birth in the format month/day/year and provide the Ontario Education Number (OEN) if applicable.

- Enter the home address including house number, street name, optional apartment or unit number, city, province, and postal code. If the mailing address differs, complete that section too.

- Specify the parent or guardian's name and provide a residence telephone number. It's important to have accurate contact details for any emergencies.

- Indicate the previous school attended, along with its contact number and the last day attended at that school.

- Complete the citizenship section by selecting the appropriate status and providing the birthplace and home language.

- If applicable, provide additional information about siblings, emergency contacts, and any specific educational needs or special programs.

- Review your entries for accuracy. After ensuring everything is correct, you can save changes, download a copy of the completed form, or share it via email.

Complete your S15 Form online today for a smooth application process.

Acquiring a new tax form is straightforward. You can download the latest version directly from the Canada Revenue Agency website or request it via phone or mail. Utilizing resources like US Legal Forms can simplify this process and ensure you have the correct documentation, including the S15 Form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.