Get Transmitter Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Transmitter Form online

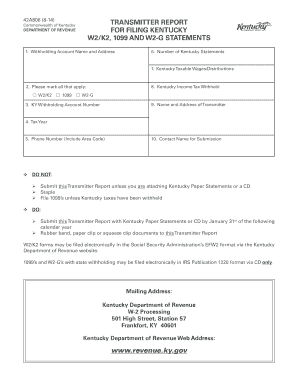

The Transmitter Form is a critical document for filing various Kentucky tax statements online, such as W2/K2, 1099, and W2-G. This guide will provide you with clear, step-by-step instructions to ensure that you accurately complete the form.

Follow the steps to successfully complete the Transmitter Form online.

- Press the ‘Get Form’ button to acquire the Transmitter Form and open it in your preferred online document editor.

- In section 1, enter the withholding account name and address as well as your associated details to ensure proper identification.

- In section 2, select all applicable options—W2/K2, 1099, or W2-G—to indicate the types of statements you are transmitting.

- Fill in your Kentucky withholding account number in section 3 to link your submission to your tax account.

- Specify the tax year in section 4 to clearly identify the applicable reporting period.

- Enter your phone number, including the area code, in section 5 for any follow-up correspondence.

- Indicate the total number of Kentucky statements you are filing in section 6.

- List the total Kentucky taxable wages or distributions in section 7 to report your financial details adequately.

- Provide the Kentucky income tax withheld in section 8 to ensure accurate taxation records.

- In section 9, enter the name and address of the transmitter to document who is sending the report.

- Fill in the contact name for submission in section 10 to facilitate communication regarding the report.

- Once all sections are completed, you can save changes, download, print, or share your completed Transmitter Form as required.

Complete your Transmitter Form online today to ensure timely submission of your Kentucky tax statements.

Filling in the tax residency self-certification form involves providing your personal details, such as your name, address, and tax identification number. Ensure that you carefully read the instructions to complete each section accurately. If you choose to submit this form digitally, using the Transmitter Form will enhance your submission experience, ensuring it reaches the appropriate tax authority seamlessly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.