Get Impact Fee Receipt

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Impact Fee Receipt online

Completing the Impact Fee Receipt online is essential for ensuring that the impact fees you pay are accurately recorded and processed. This guide provides a clear, step-by-step approach to filling out the online form, making the process straightforward for all users.

Follow the steps to effectively complete your Impact Fee Receipt online.

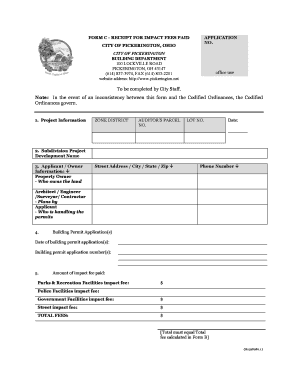

- Press the ‘Get Form’ button to access the form and open it in your chosen editing tool.

- Enter the project information including the zone district, auditor's parcel number, and lot number in the specified fields. This information helps in identifying the project and ensures proper processing.

- Fill in the subdivision project development name. This identifies the project associated with the impact fee.

- Provide the applicant or owner information. Include the property owner's name, full address, and contact phone number.

- Complete the details of the architect, engineer, surveyor, or contractor who is handling the permits. This is important for maintaining communication regarding the project.

- Enter the date of building permit application(s) and the corresponding building permit application number(s). This ties the impact fee receipt to the specific permits that are relevant.

- Input the amount of impact fee paid for each specified category: parks and recreation facilities, police facilities, government facilities, and street impact fee. Ensure that these fees sum up to reflect a total amount.

- If the impact fee payment is $0, select one of the reasons for this status. Make sure to include any necessary supporting information as required.

- Choose the method of impact fee payment. This could include cash, personal check, certified check, money order, or other forms. Be specific where necessary.

- Sign and date the receipt where indicated. Ensure that your printed name and title are clear, adding credibility to the receipt.

- Indicate to whom the signed copy will be provided, ensuring that the proper channels of communication are maintained.

- Finally, save changes, download, print, or share the form as needed to complete the process.

Complete your Impact Fee Receipt online now for efficient processing.

In Texas, impact fees serve as a financial mechanism to help local governments fund infrastructure impacted by new developments. These fees often cover roads, parks, and water services. When you acquire your Impact Fee Receipt in Texas, it confirms the fee's purpose and usage, emphasizing your role in the sustainable growth of your community. Understanding impact fees is crucial as they directly influence overall development costs.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.