Loading

Get Ir3-2010 - Inland Revenue Department - Ird Govt

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ir3-2010 - Inland Revenue Department - Ird Govt online

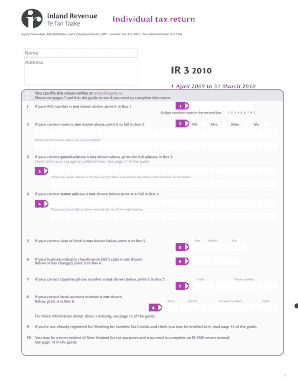

Filling out the Ir3-2010 form from the Inland Revenue Department is essential for reporting your income for the specified tax year. In this guide, we will offer a step-by-step process to help you complete the form accurately and efficiently while filing online.

Follow the steps to successfully complete your Ir3-2010 form.

- Click the ‘Get Form’ button to access the Ir3-2010 form and open it for editing.

- Begin by entering your IRD number in Box 1. If it is not pre-filled, print it clearly in the designated area.

- In Box 2, ensure your correct name is printed in full. Use proper formatting: first names above and surname below.

- Check and enter your correct postal address in Box 3. Remember, do not use your tax agent’s address here.

- If there are any discrepancies in your street address, update Box 4 with the full details.

- Enter your date of birth in Box 5 if it’s not shown correctly.

- Update Box 6 with your business industry classification code if it has changed.

- Provide your correct daytime phone number in Box 7.

- Enter your bank account number in Box 8 to ensure any credits are directed properly.

- Proceed to the income section, starting with whether you received family tax credits from Work and Income. Follow the prompts in the form for accurate entries.

- Continue filling in the income details, ensuring to refer to your summary of earnings for accurate figures. Follow each question through to ensure nothing is missed.

- Calculate your total income by adding the necessary boxes as instructed, and ensure your income after expenses is accurately represented in Box 27.

- As you complete the form, verify all entries to ensure accuracy and completeness, including tax credits and calculations.

- Once completed, save your changes, download a copy for your records, and proceed to print or share as necessary.

Complete the Ir3-2010 form online to ensure your tax obligations are met accurately and efficiently.

Yes, you need to file a tax return in New Zealand if you earn income. This includes salaries, wages, and any other income sources. Filing ensures that you comply with the regulations set by the Ir3-2010 - Inland Revenue Department - Ird Govt., and it might entitle you to refunds or credits. Always stay informed about your taxation obligations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.