Get Itcp Full Form Income Tax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Itcp Full Form Income Tax online

Filling out the Itcp Full Form Income Tax online requires careful attention to detail. This guide will walk you through the necessary steps and provide insights into each component of the form to ensure a smooth submission process.

Follow the steps to complete the Itcp Full Form Income Tax online.

- Click the ‘Get Form’ button to access the Itcp Full Form Income Tax. This will open the form in your preferred editor for filling out.

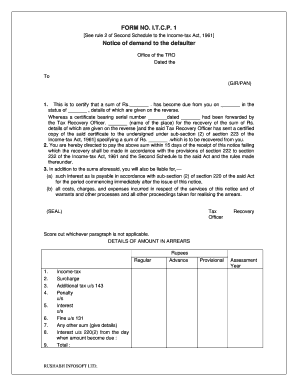

- Begin by entering your General Identification Number (GIR) or Permanent Account Number (PAN) in the designated field. Ensure that these numbers are accurate to avoid processing delays.

- In the field labeled 'This is to certify that a sum of Rs._______', enter the amount that has become due from you. Make sure to enter the correct figure to reflect your outstanding obligation.

- Next, fill in the date associated with the due amount in the specified field. This date should correspond with the date you received the notice or when the amount became due.

- Indicate your status in the provided section. This may include categories such as individual, business, etc. Select the one that accurately represents your situation.

- Complete the reference to the certificate by adding the serial number and date of the notice from the Tax Recovery Officer. This information is crucial for record-keeping and identification purposes.

- After addressing the initial informational fields, proceed to fill out the details regarding the amount in arrears. Include income tax, surcharge, penalties, interest, and any other applicable fees. Sum these amounts accurately in the 'Total' section.

- Review all entered information carefully to ensure that there are no mistakes. Accuracy is vital in tax-related documents to prevent any issues with processing.

- Once you have double-checked the form and confirmed that all fields are filled out correctly, you can save your changes. The options to download, print, or share the form will be available at this stage.

Start completing your Itcp Full Form Income Tax online today for a hassle-free experience.

Related links form

TDD stands for Tax Deducted at Source. It's an important concept in the income tax framework where the tax amount is deducted directly from the income before it reaches the taxpayer. Understanding the Itcp Full Form Income Tax is crucial, as it helps you comprehend how TDD works to ensure compliance with tax regulations. By familiarizing yourself with this aspect, you can effectively manage your tax obligations and optimize your financial planning.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.