Loading

Get Kiwisaver Deduction Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Kiwisaver Deduction Form online

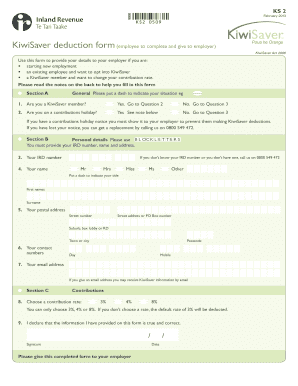

Completing the Kiwisaver Deduction Form is an essential step for people starting new employment or wishing to update their KiwiSaver contributions. This guide provides clear instructions to help users successfully navigate the online form submission process.

Follow the steps to complete your Kiwisaver Deduction Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Section A, indicate your situation by placing a dash next to the appropriate option. Specify if you are a KiwiSaver member and if you are on a contributions holiday.

- Proceed to Section B, where you must fill out your personal details using block letters. Provide your IRD number, full name, and postal address.

- Continue with your contact numbers, including a day phone and mobile number, followed by your email address. Providing an email allows for potential KiwiSaver updates.

- In Section C, choose your desired contribution rate from the options of 3%, 4%, or 8%. If a contribution rate is not selected, the default of 3% will apply.

- Finally, declare that the information provided is true and correct by signing and dating the form. Make sure all fields are complete before submission.

- Once completed, save your changes and download the form, or print it out. Ensure to give the completed form to your employer for processing.

Start completing your Kiwisaver Deduction Form online today for a smoother employment transition.

To receive KiwiSaver government contributions, you need to make personal contributions to your KiwiSaver account. The government matches contributions up to a certain limit, benefiting your retirement savings. You can easily track your contributions and ensure you are eligible for these benefits. Remember, filling out the KiwiSaver Deduction Form will help streamline your contributions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.